Key Events This Week

27 Jan: Sharp open interest surge amid bearish momentum

28 Jan: Intraday high with strong 3.28% surge

29 Jan: Significant open interest increase amid mixed signals

30 Jan: Week closes at Rs.167.15 (-0.09%)

GAIL (India) Ltd Sees Significant Open Interest Surge Amid Mixed Market Signals

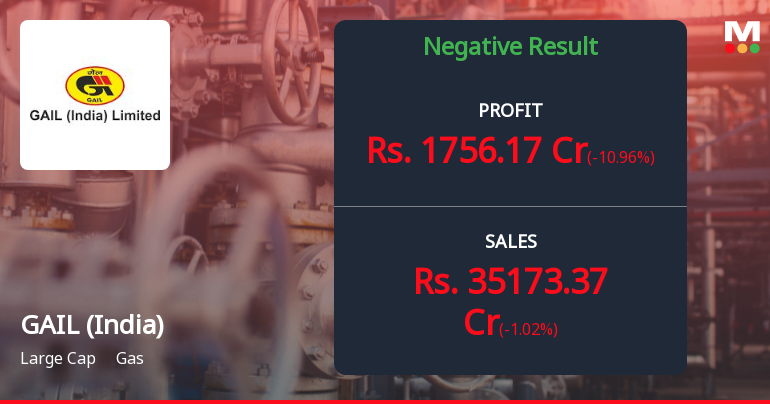

2026-01-29 15:00:15GAIL (India) Ltd has witnessed a notable 10.01% increase in open interest in its derivatives segment, signalling heightened market activity despite the stock underperforming its sector and broader indices. This surge in open interest, coupled with volume and price dynamics, offers insights into evolving market positioning and potential directional bets among traders.

Read full news article

GAIL (India) Ltd Hits Intraday High with Strong 3.28% Surge on 28 Jan 2026

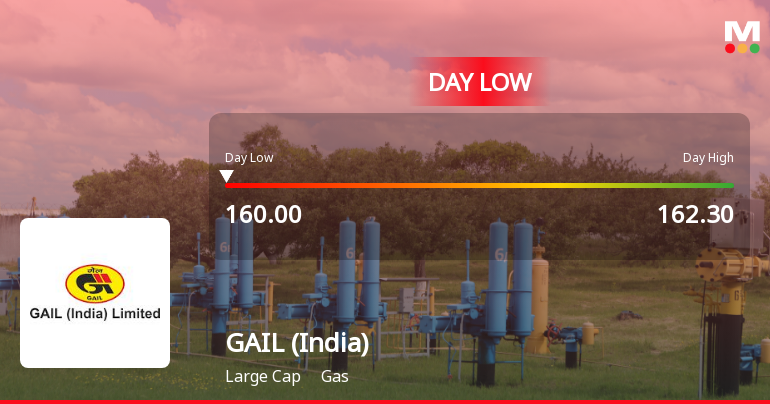

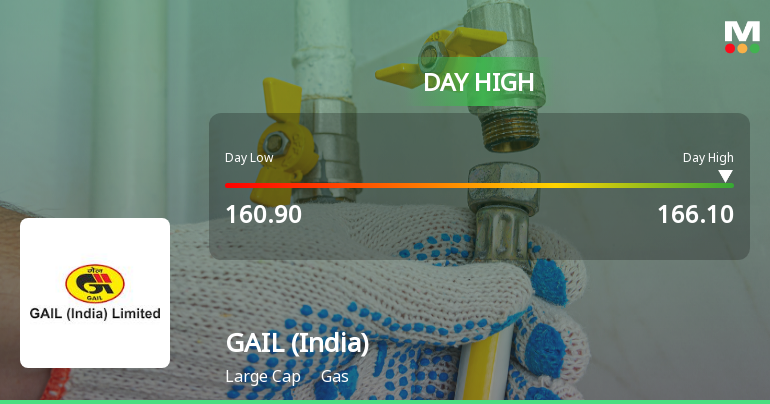

2026-01-28 10:32:58GAIL (India) Ltd demonstrated robust intraday strength on 28 Jan 2026, surging to an intraday high of Rs 165.2, marking a 3.25% increase and outperforming its sector and the broader market indices.

Read full news article

GAIL (India) Ltd Sees Sharp Open Interest Surge Amid Bearish Momentum

2026-01-27 15:00:33GAIL (India) Ltd has witnessed a notable 18.5% surge in open interest in its derivatives segment, signalling increased market activity despite the stock’s recent downward price trend. This rise in open interest, coupled with declining investor participation and a deteriorating mojo grade, suggests a complex positioning landscape with potential directional bets emerging among traders.

Read full news article

GAIL (India) Ltd Sees Sharp Open Interest Surge Amid Bearish Market Signals

2026-01-27 14:00:19GAIL (India) Ltd has witnessed a significant 16.0% surge in open interest in its derivatives segment, signalling heightened market activity and shifting investor positioning. Despite this spike, the stock continues to trade below all major moving averages, reflecting persistent bearish sentiment amid falling investor participation and a recent downgrade to a Sell rating by MarketsMOJO.

Read full news article