Key Events This Week

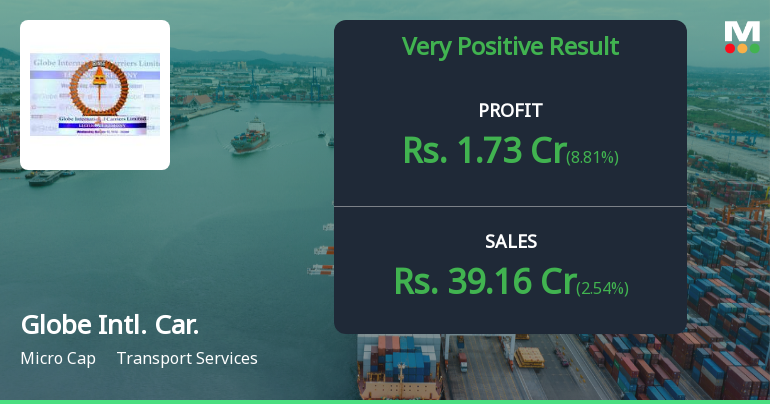

16 Feb: Very positive quarterly financial performance announced

16 Feb: Bullish momentum shift confirmed by technical indicators

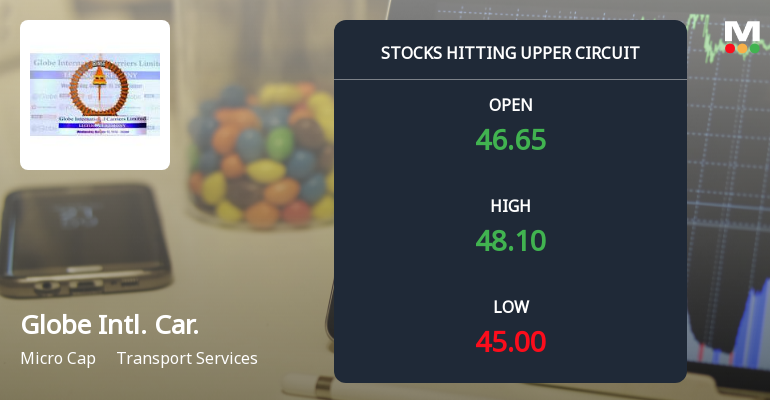

17 Feb: Stock hits upper circuit amid strong buying pressure

17 Feb: Valuation shift highlights price attractiveness amid sector comparisons

20 Feb: Week closes at ₹50.55 (+10.25%) outperforming Sensex

Globe International Carriers Ltd Hits Upper Circuit Amid Robust Buying Pressure

2026-02-17 15:00:09Shares of Globe International Carriers Ltd surged to hit the upper circuit limit on 17 Feb 2026, propelled by strong buying interest and heightened investor participation. The stock closed at ₹48.00, marking a maximum daily gain of 4.69%, significantly outperforming its sector and benchmark indices amid robust volumes and unfilled demand.

Read full news article

Globe International Carriers Q3 FY26: Stellar Profit Surge Masks Valuation Concerns

2026-02-17 08:49:15Globe International Carriers Ltd., a Jaipur-based transport services company with a market capitalisation of ₹522.00 crores, delivered an exceptional Q3 FY26 performance with consolidated net profit surging 185.62% year-on-year to ₹4.37 crores. The micro-cap logistics player demonstrated remarkable operating leverage, with operating margins expanding to 21.52% from 7.07% in the year-ago quarter, driven by robust revenue growth of 23.49% to ₹47.31 crores.

Read full news article

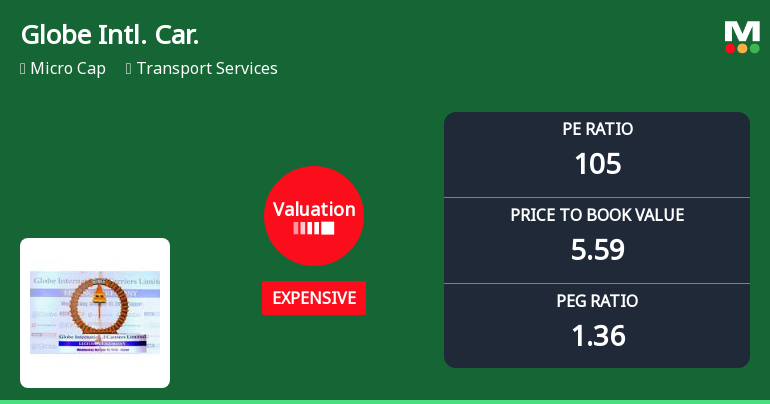

Globe International Carriers Ltd: Valuation Shift Highlights Price Attractiveness Amid Sector Comparisons

2026-02-17 08:03:56Globe International Carriers Ltd has experienced a notable shift in its valuation parameters, moving from a very expensive to an expensive rating, reflecting evolving price attractiveness in the transport services sector. Despite a high price-to-earnings (P/E) ratio of 104.54 and a price-to-book value (P/BV) of 5.59, the company’s strong long-term returns and improving market sentiment underpin a Buy rating with a Mojo Score of 71.0, upgraded from Hold.

Read full news article

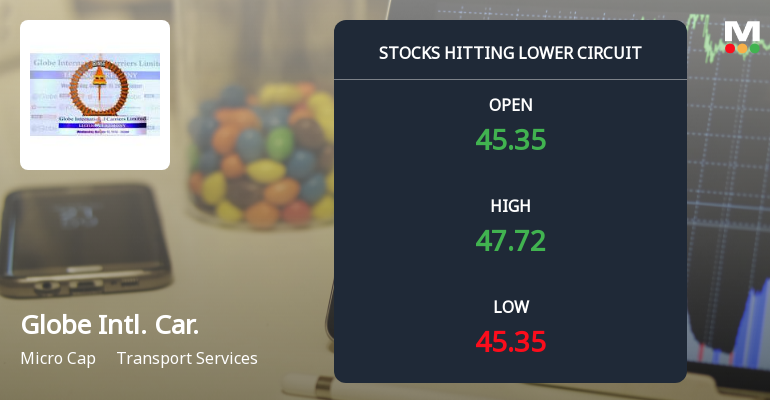

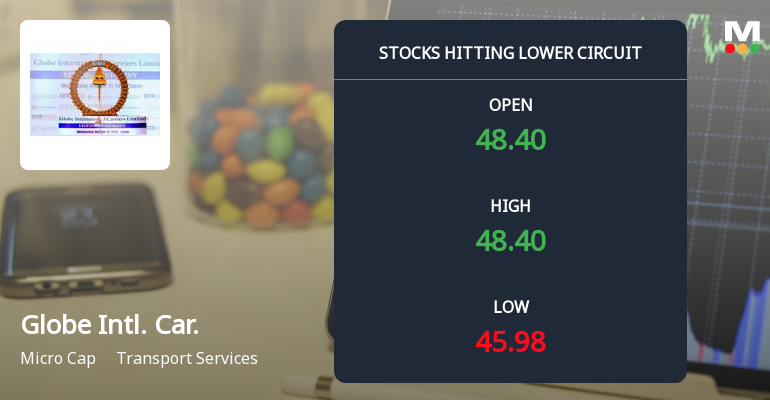

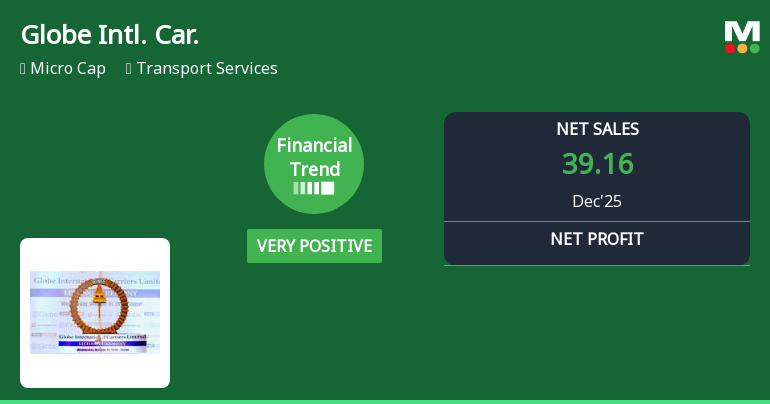

Globe International Carriers Ltd Reports Very Positive Quarterly Financial Performance Amid Strong Growth

2026-02-16 11:00:26Globe International Carriers Ltd has delivered a very positive financial performance in the quarter ended December 2025, marked by robust revenue growth and significant margin expansion. The company’s financial trend score surged from 4 to 22 over the past three months, reflecting a marked improvement in operational efficiency and profitability metrics.

Read full news article