Key Events This Week

2 Feb: Stock opens at ₹44.32, declines 3.65% amid broader market weakness

3 Feb: Minor decline of 0.65% despite Sensex rallying 2.63%

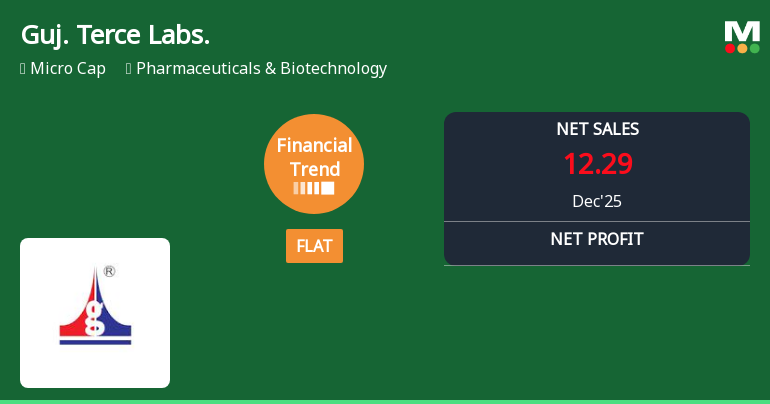

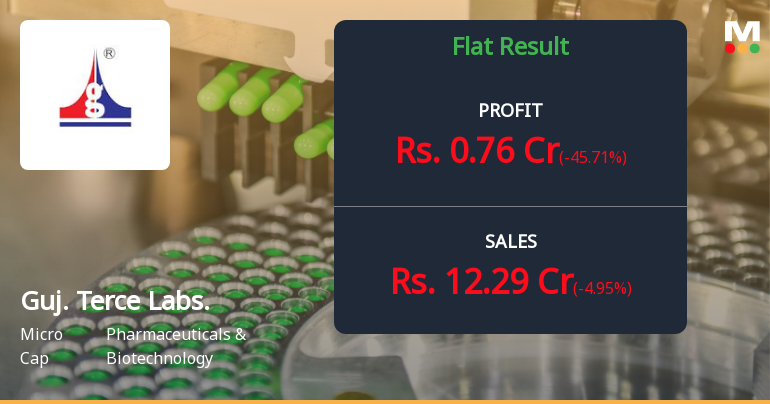

4 Feb: Stock rebounds 2.29% following Q3 results revealing profitability collapse

5 Feb: Sharp 5.40% drop on flat quarterly performance and margin pressure news

6 Feb: Recovery of 3.85% on low volume, closing at ₹44.25