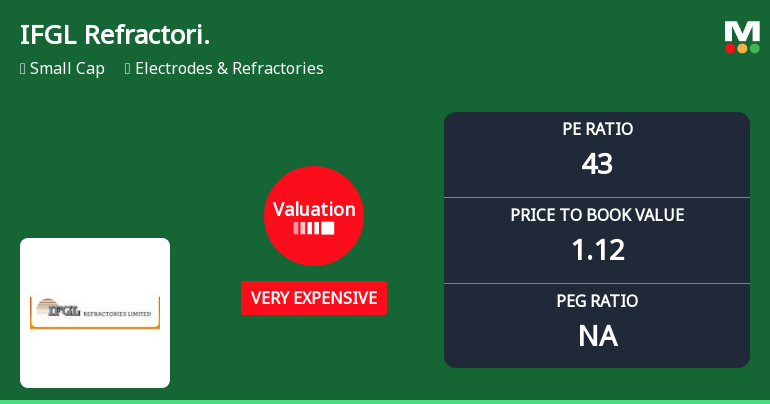

IFGL Refractories Ltd Valuation Shifts to Very Expensive Amidst Market Pressure

2026-01-30 08:01:18IFGL Refractories Ltd has seen a marked shift in its valuation parameters, moving from an expensive to a very expensive rating, driven primarily by a surge in its price-to-earnings (P/E) ratio. Despite this, the company’s recent returns have lagged behind the broader Sensex index, raising questions about the stock’s price attractiveness in the current market environment.

Read full news article

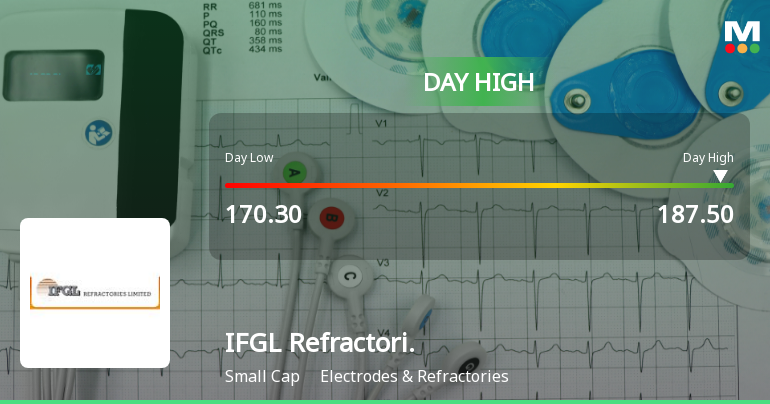

IFGL Refractories Ltd Hits Intraday High with 8.6% Surge on 29 Jan 2026

2026-01-29 14:51:48IFGL Refractories Ltd recorded a robust intraday performance on 29 Jan 2026, surging 8.6% to touch a day’s high of Rs 187.5. This significant uptick outpaced the broader market and sector indices, reflecting heightened trading activity and volatility within the Electrodes & Refractories industry.

Read full news article

IFGL Refractories Ltd is Rated Sell

2026-01-22 10:10:04IFGL Refractories Ltd is rated Sell by MarketsMOJO, with this rating last updated on 27 October 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 22 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

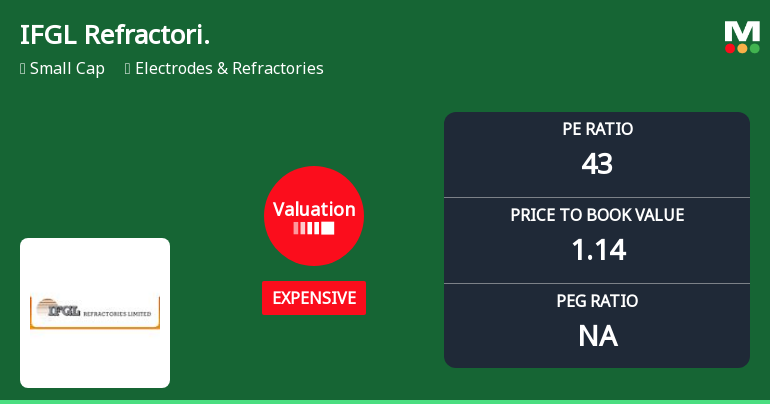

IFGL Refractories Ltd Valuation Shifts Signal Price Attractiveness Change

2026-01-22 08:01:10IFGL Refractories Ltd has experienced a notable shift in its valuation parameters, moving from a very expensive to an expensive rating, accompanied by a significant decline in share price and deteriorating market sentiment. This article analyses the recent changes in key valuation metrics, compares them with peer averages and historical benchmarks, and assesses the implications for investors amid a challenging market environment.

Read full news article

IFGL Refractories Ltd is Rated Sell

2026-01-11 10:10:15IFGL Refractories Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 27 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 11 January 2026, providing investors with an up-to-date view of the company's fundamentals, valuation, financial trends, and technical outlook.

Read full news article

IFGL Refractories Ltd Faces Bearish Momentum Amid Technical Downturn

2026-01-06 08:34:20IFGL Refractories Ltd has experienced a notable shift in its technical momentum, with key indicators signalling a transition from a mildly bearish to a more pronounced bearish trend. Despite recent positive returns over short-term periods, the stock’s technical parameters suggest caution for investors as momentum indicators and moving averages align with a downtrend.

Read full news article

IFGL Refractories Ltd Sees Mixed Technical Signals Amid Price Momentum Shift

2026-01-05 08:08:20IFGL Refractories Ltd has experienced a notable shift in price momentum, reflected in a complex blend of technical indicator signals that suggest a cautious outlook for investors. Despite a recent daily gain of 4.29%, the company’s technical grades and momentum oscillators reveal a market grappling with uncertainty amid broader sector and market trends.

Read full news article

IFGL Refractories Ltd is Rated Sell

2025-12-31 10:10:03IFGL Refractories Ltd is rated Sell by MarketsMOJO, with this rating last updated on 27 Oct 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 31 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

IFGL Refractories Technical Momentum Shifts Amid Bearish Indicators

2025-12-22 08:05:02IFGL Refractories has experienced a notable shift in its technical momentum, with multiple indicators signalling a bearish trend across weekly and monthly timeframes. Despite a recent uptick in daily price, the broader technical landscape suggests caution for investors as the stock navigates a challenging phase within the Electrodes & Refractories sector.

Read full news articleIFGL Refractories Limited - Updates

18-Nov-2019 | Source : NSEIFGL Refractories Limited has informed the Exchange regarding 'Kindly be informed that the Company has been accorded status of Two Star Export House by the Directorate General of Foreign Trade, Ministry of Commerce & Industry for the period of five years effective from 20.09.2019. Copy of Certificate of Recognition received in this regard is enclosed herewith which is also being hosted on Company s Website: www.ifglref.com.'.

IFGL Refractories Limited - Investor Presentation

13-Nov-2019 | Source : NSEIFGL Refractories Limited has informed the Exchange regarding Investor Presentation

IFGL Refractories Limited - Analysts/Institutional Investor Meet/Con. Call Updates

04-Nov-2019 | Source : NSEIFGL Refractories Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates.

Corporate Actions

No Upcoming Board Meetings

IFGL Refractories Ltd has declared 10% dividend, ex-date: 06 Jun 25

No Splits history available

IFGL Refractories Ltd has announced 1:1 bonus issue, ex-date: 18 Jul 25

No Rights history available