Recent Price Movements and Market Performance

Indo National Ltd has experienced a significant decline in its share price over multiple time frames. In the past week, the stock has dropped by 6.98%, nearly double the Sensex's decline of 3.67%. Over the last month, the stock's fall of 16.99% starkly contrasts with the Sensex's modest 1.75% loss. Year-to-date, the stock has plummeted 23.47%, while the benchmark index has only declined 5.85%. The one-year performance is even more concerning, with Indo National Ltd shedding 28.96% against a 9.62% gain in the Sensex. This underperformance extends to the three- and five-year horizons, where the stock has lagged the market by wide margins.

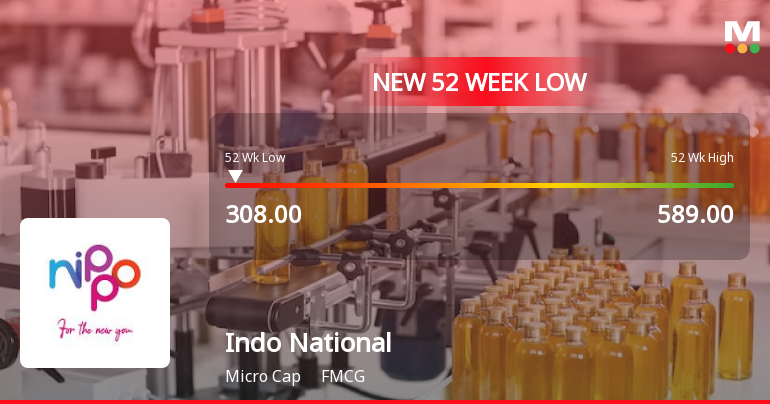

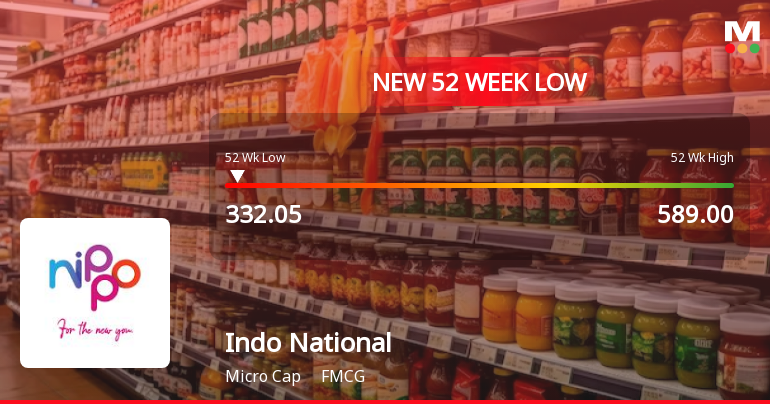

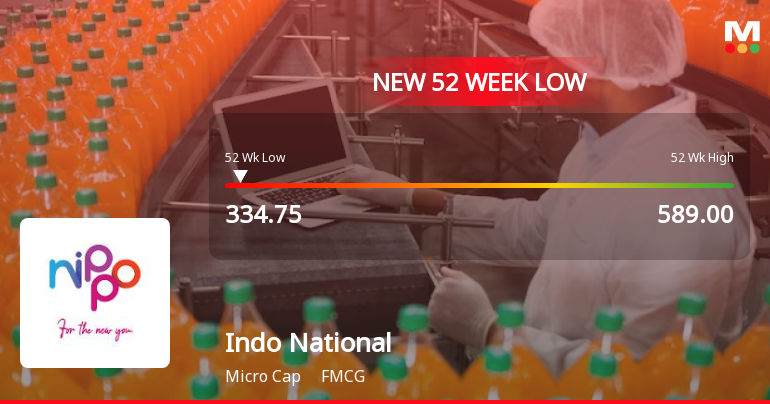

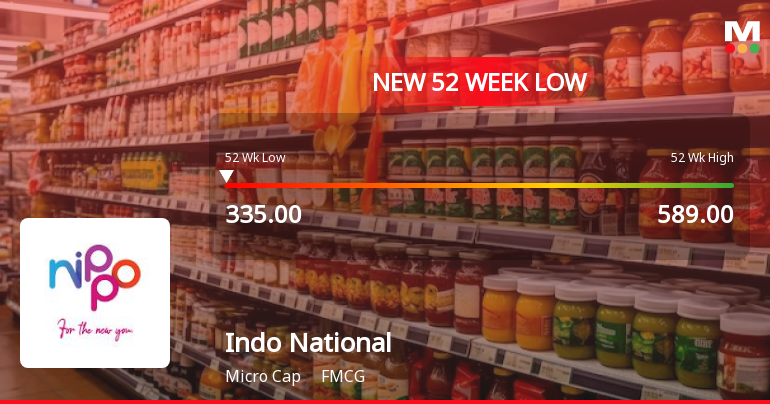

Today's trading session underscored the stock's vulnerability. Indo National Ltd opened ...

Read full news article