Key Events This Week

29 Dec: Stock opens week at ₹623.00, declines 2.26%

30 Dec: Robust value trading with 4.22% gain amid mixed technical signals

31 Dec: Technical momentum shifts with 1.11% decline despite mixed market signals

1 Jan: Minor decline of 0.27% with subdued volume

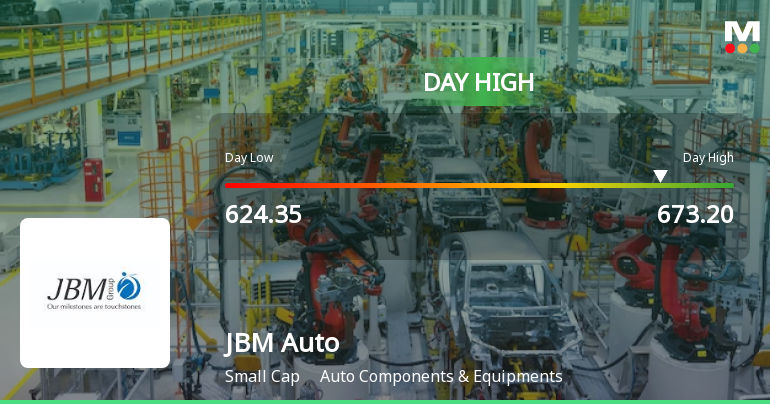

2 Jan: Intraday high of ₹673.20 and strong 6.57% surge closing at ₹667.05

JBM Auto Ltd is Rated Strong Sell

2026-01-03 10:10:34JBM Auto Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 01 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 03 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

JBM Auto Ltd Hits Intraday High with 7.05% Surge on 2 January 2026

2026-01-02 11:31:07JBM Auto Ltd demonstrated robust intraday performance on 2 Jan 2026, surging to an intraday high of Rs 673.2, marking a 7.56% increase from its previous close. This notable rally outpaced the Auto Components & Equipments sector and broader market indices, reflecting a significant rebound after two days of decline.

Read full news article

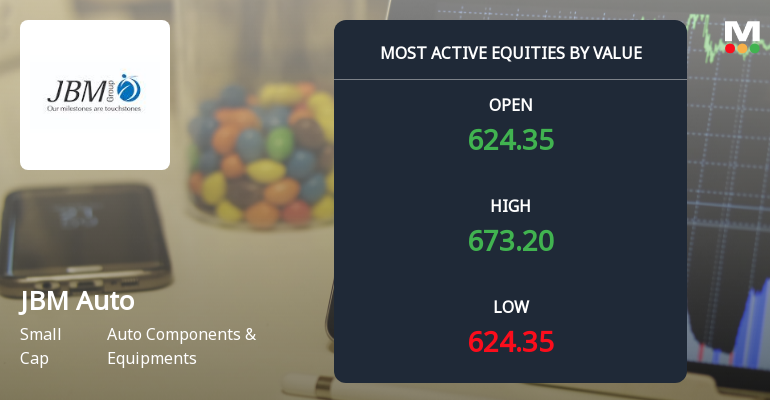

JBM Auto Ltd Sees Robust Trading Activity Amid Strong Market Outperformance

2026-01-02 10:00:19JBM Auto Ltd (JBMA) witnessed a robust trading session on 2 Jan 2026, emerging as one of the most actively traded stocks by value on the Indian equity markets. The auto components and equipment manufacturer recorded a significant uptick in its share price, closing at ₹667.95, up 6.57% from the previous close of ₹625.65. This surge was accompanied by a substantial turnover of ₹204.55 crores on a volume of 31.01 lakh shares, signalling strong institutional interest and large order flow driving the momentum.

Read full news article

JBM Auto Ltd Technical Momentum Shifts Amid Mixed Market Signals

2025-12-31 08:06:57JBM Auto Ltd has experienced a notable shift in price momentum, reflected in a complex mix of technical indicators that suggest a cautiously bearish outlook. Despite a strong day change of 4.22%, the company’s technical parameters reveal a nuanced picture, with some indicators signalling mild bearishness while others remain neutral or bullish, underscoring the need for investors to carefully weigh the evolving market dynamics.

Read full news article

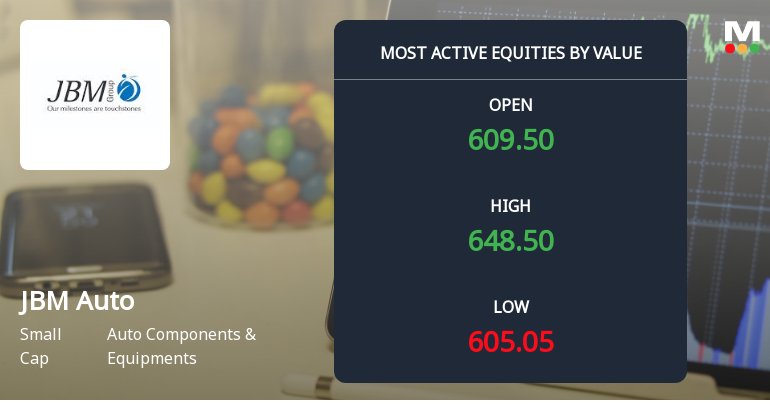

JBM Auto Ltd Sees Robust Value Trading Amid Mixed Technical Signals

2025-12-30 11:00:07JBM Auto Ltd (JBMA) emerged as one of the most actively traded stocks by value on 30 Dec 2025, registering a significant intraday rally that outpaced its sector and benchmark indices. Despite a recent downgrade to a Strong Sell rating by MarketsMOJO, the stock demonstrated notable resilience with a 3.96% gain and strong institutional interest, reflecting a complex market dynamic in the auto components sector.

Read full news article