Recent Price Trends and Relative Performance

Jhaveri Credits & Capital Ltd’s current price movement shows a marginal rise of ₹0.55 or 0.29% as of the evening trading session on 23 January. This increase follows two consecutive days of gains, during which the stock appreciated by approximately 4.97%. However, this short-term positive momentum contrasts with the broader trend observed over the past week and month, where the stock declined by 5.43% and 5.96% respectively. These declines are steeper than the Sensex’s corresponding losses of 2.43% and 4.66%, indicating that Jhaveri Credits has been underperforming the benchmark index.

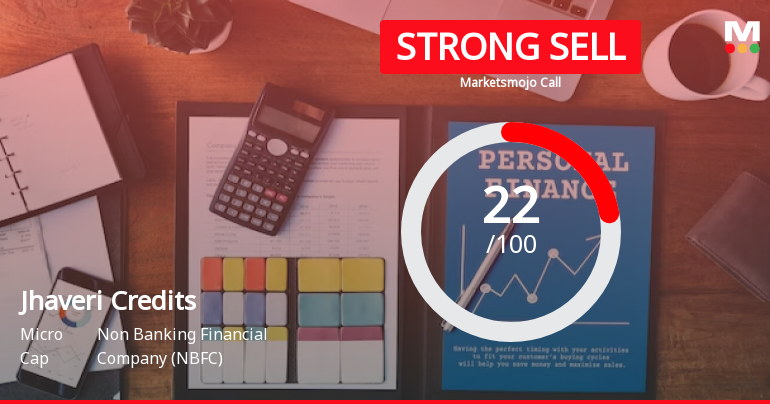

Year-to-date, the stock has fallen by 13.62%, significantly lagging behind the Sensex’s 4.32% decline. Over the last twelve months, the d...

Read full news article