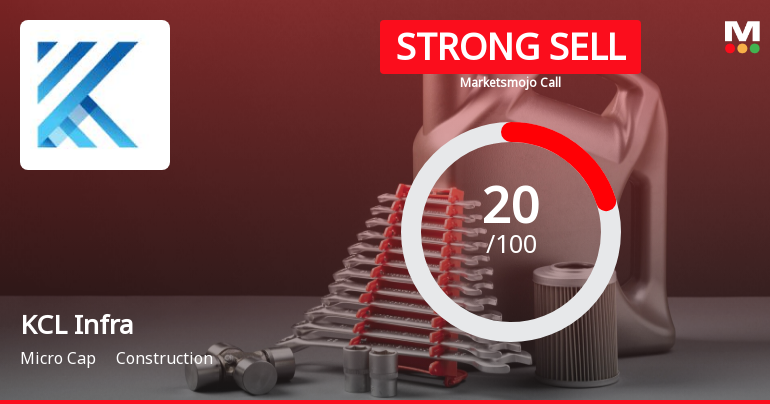

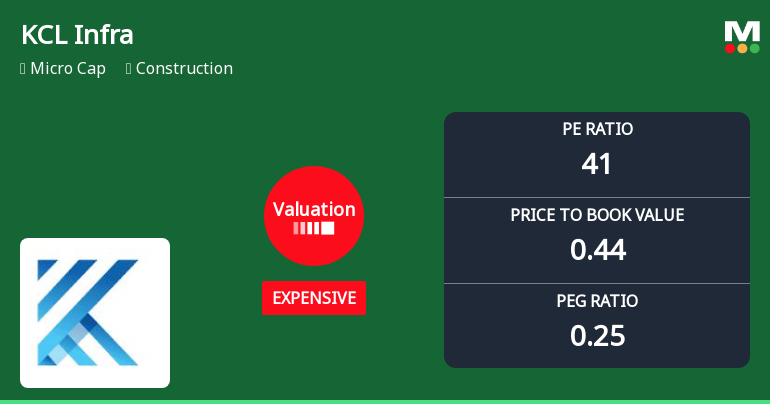

Valuation Metrics and Financial Health

KCL Infra’s price-to-earnings (PE) ratio stands at approximately 40, which is relatively high for a construction company, signalling that the stock is priced at a premium compared to its earnings. However, the price-to-book (P/B) value is notably low at 0.43, suggesting the market values the company below its net asset value. This divergence indicates mixed signals about the company’s valuation.

Enterprise value (EV) multiples such as EV to EBIT and EV to EBITDA are negative, reflecting operational challenges and losses at the earnings before interest and tax level. The company’s return on capital employed (ROCE) is negative at -3.11%, while return on equity (ROE) is marginally positive at 1.08%. These figures highlight subdued pr...

Read full news article