Key Events This Week

Jan 27: Maharashtra Seamless hits 52-week low at Rs.500

Jan 28: Q3 FY26 results reveal stellar profit surge

Jan 30: Week closes at Rs.519.70 (+2.22%) outperforming Sensex

Are Maharashtra Seamless Ltd latest results good or bad?

2026-01-28 19:15:59The latest financial results for Maharashtra Seamless Ltd reveal a complex picture characterized by contrasting operational performance and profitability metrics. For the quarter ending December 2025, the company reported consolidated net profit of ₹242.86 crores, which reflects a year-on-year growth of 30.52%. This increase is primarily attributed to a significant rise in other income, which accounted for a substantial portion of the profit before tax, raising concerns about the sustainability of these earnings. In terms of revenue, Maharashtra Seamless experienced a decline in net sales, reporting ₹1,090.29 crores, which represents a year-on-year decrease of 22.57%. This decline highlights ongoing demand challenges within the seamless pipe segment, suggesting potential issues with market share or sector-specific headwinds. The operating profit margin, excluding other income, improved to 13.97% from the p...

Read full news article

Maharashtra Seamless Q3 FY26: Stellar Profit Surge Masks Revenue Concerns

2026-01-28 18:16:52Maharashtra Seamless Ltd., the flagship seamless pipe manufacturer of the DP Jindal Group, posted a remarkable 93.88% quarter-on-quarter surge in consolidated net profit to ₹242.86 crores in Q3 FY26, yet the celebration is tempered by a concerning 5.90% sequential decline in net sales to ₹1,090.29 crores. The small-cap steel products manufacturer, with a market capitalisation of ₹6,838 crores, continues to grapple with revenue headwinds even as extraordinary other income of ₹199.95 crores—representing a staggering 62.59% of profit before tax—artificially inflated bottom-line performance.

Read full news article

Maharashtra Seamless Ltd Stock Hits 52-Week Low at Rs.500

2026-01-27 10:19:46Maharashtra Seamless Ltd’s shares touched a new 52-week low of Rs.500 today, marking a significant decline amid broader market fluctuations. The stock has underperformed its sector and the broader market over the past year, reflecting a series of financial setbacks and valuation pressures.

Read full news article

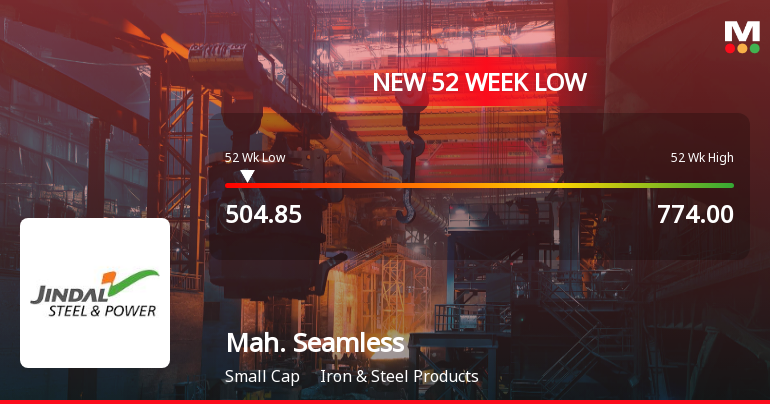

Maharashtra Seamless Ltd Stock Falls to 52-Week Low of Rs.504.85

2026-01-21 12:06:54Maharashtra Seamless Ltd’s share price declined to a fresh 52-week low of Rs.504.85 today, marking a significant downturn amid broader market weakness and company-specific financial setbacks. The stock has now recorded a four-day consecutive fall, accumulating a loss of 3.84% over this period, underperforming its sector and the broader indices.

Read full news article

Maharashtra Seamless Ltd is Rated Sell

2026-01-21 10:10:03Maharashtra Seamless Ltd is rated Sell by MarketsMOJO, with this rating last updated on 04 Sep 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 21 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Maharashtra Seamless Ltd Stock Hits 52-Week Low at Rs.511.35

2026-01-20 10:51:59Maharashtra Seamless Ltd, a key player in the Iron & Steel Products sector, recorded a new 52-week low of Rs.511.35 today, marking a significant decline amid broader market fluctuations and company-specific performance pressures.

Read full news article

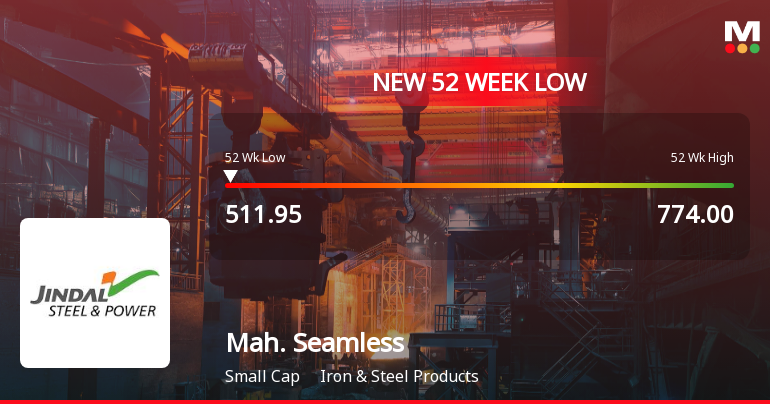

Maharashtra Seamless Ltd Stock Falls to 52-Week Low of Rs.511.95

2026-01-19 10:02:08Maharashtra Seamless Ltd’s shares declined to a fresh 52-week low of Rs.511.95 on 19 Jan 2026, marking a significant downturn amid broader market weakness and company-specific financial pressures. The stock has underperformed its sector and the broader market over the past year, reflecting a challenging period for the iron and steel products company.

Read full news article