Northwest Bancshares Forms Golden Cross, Signaling Potential Bullish Breakout

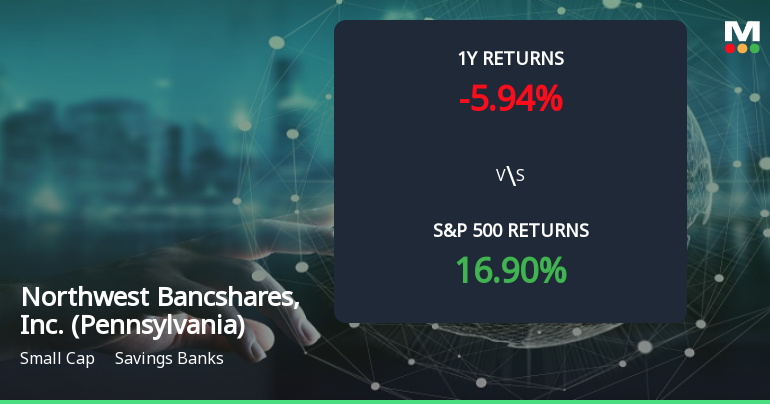

2025-10-28 14:49:17Northwest Bancshares, Inc. has recently experienced a Golden Cross, indicating potential upward momentum. Despite a year-over-year decline of 5.94%, the stock has shown short-term resilience. With a market capitalization of approximately $1.84 billion and a price-to-earnings ratio of 12.32, it remains a notable player in the savings banks industry.

Read full news articleNo announcement available

Corporate Actions

No corporate action available