Key Events This Week

2 Feb: Quality upgrade and rating raised to Sell

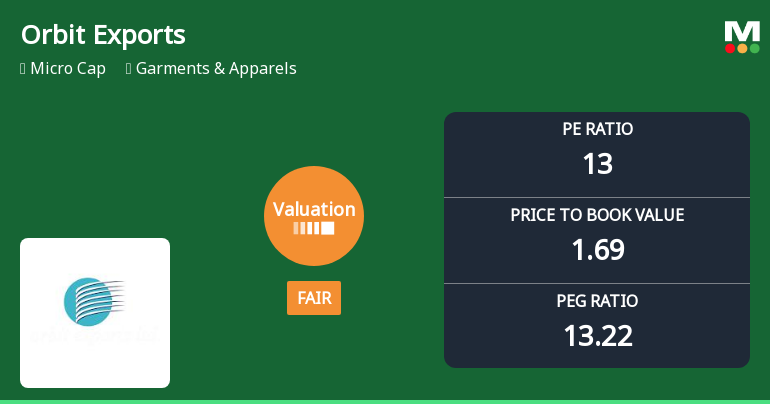

5 Feb: Valuation grade shifts from attractive to fair

6 Feb: Week closes at Rs.183.70 (+6.34%) outperforming Sensex

Orbit Exports Ltd Valuation Shifts to Fair Amid Mixed Market Performance

2026-02-05 08:00:54Orbit Exports Ltd, a key player in the Garments & Apparels sector, has witnessed a notable shift in its valuation parameters, moving from an attractive to a fair rating. This change reflects evolving market perceptions amid fluctuating price-to-earnings (P/E) and price-to-book value (P/BV) ratios, as well as comparisons with industry peers. Investors are now reassessing the stock’s price attractiveness in light of these developments and broader market trends.

Read full news articleWhy is Orbit Exports Ltd falling/rising?

2026-02-04 01:09:03

Strong Intraday Performance and Sector Momentum

Orbit Exports opened the trading session with a gap-up of 9.93%, setting a positive tone for the day. The stock further extended gains to touch an intraday high of ₹192.15, representing a 13.97% increase from the previous close. This robust performance was complemented by the textile sector’s own rally, which gained 8.19% on the same day, indicating a broader sectoral uptrend that likely buoyed investor sentiment towards Orbit Exports.

Despite the strong intraday gains, the stock’s price remains below its longer-term moving averages, including the 50-day, 100-day, and 200-day averages. However, it has surpassed its 5-day and 20-day moving averages, suggesting a short-term positive momentum that may be attracting traders l...

Read full news article

Orbit Exports Ltd Upgraded to Sell on Improved Quality and Valuation Metrics

2026-02-02 08:11:45Orbit Exports Ltd, a player in the Garments & Apparels sector, has seen its investment rating upgraded from Strong Sell to Sell as of 1 February 2026. This change reflects notable improvements in the company’s quality and valuation metrics, despite ongoing challenges in its financial performance and technical indicators. The revised Mojo Score now stands at 36.0, signalling a cautious but more favourable outlook for investors.

Read full news article

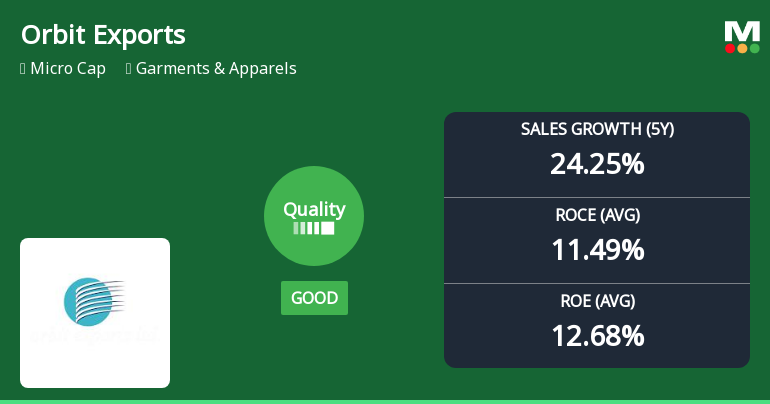

Orbit Exports Ltd Quality Upgrade Signals Improving Business Fundamentals Amid Mixed Market Returns

2026-02-02 08:00:20Orbit Exports Ltd, a player in the Garments & Apparels sector, has witnessed a notable upgrade in its quality grading from average to good, reflecting improvements in key business fundamentals. Despite this positive shift, the company’s overall market sentiment remains cautious, with a Mojo Score of 36.0 and a Sell rating, albeit improved from a previous Strong Sell. This article delves into the factors behind the quality upgrade, analysing profitability, capital efficiency, debt levels, and consistency metrics to provide a comprehensive view of the company’s evolving financial health.

Read full news articleAre Orbit Exports Ltd latest results good or bad?

2026-01-31 19:17:31The latest financial results for Orbit Exports Ltd for the quarter ended December 2025 indicate a challenging operational environment. The company reported consolidated net profit of ₹6.56 crores, reflecting a significant decline of 34.73% compared to the previous quarter. This drop in profitability is attributed to a substantial decrease in other income, which fell from ₹4.77 crores to ₹1.13 crores, highlighting the company's reliance on non-operating income streams. Net sales for the quarter stood at ₹56.36 crores, which represents a sequential decline of 3.29% from ₹58.28 crores in the previous quarter. Despite this, the year-on-year comparison shows a modest growth of 4.41%, indicating some resilience against last year's performance. The operating margin, excluding other income, improved slightly to 21.32%, up from 20.77% in the previous quarter, suggesting that core operational efficiency was relative...

Read full news article

Orbit Exports Q3 FY26: Profit Plunges 35% as Margin Pressures Mount

2026-01-30 20:01:28Orbit Exports Ltd., the Mumbai-based novelty fabric manufacturer, reported a sharp 34.73% quarter-on-quarter decline in consolidated net profit to ₹6.56 crores for Q3 FY26, down from ₹10.05 crores in Q2 FY26. The ₹455 crore market capitalisation company saw revenues contract 3.29% sequentially to ₹56.36 crores, whilst operating margins compressed to 21.32% from 20.77% in the previous quarter. The disappointing performance marks the second consecutive quarter of profit decline, raising concerns about the sustainability of the company's earnings trajectory in a challenging textile industry environment.

Read full news articleWhen is the next results date for Orbit Exports Ltd?

2026-01-28 23:16:05The next results date for Orbit Exports Ltd is scheduled for 30 January 2026....

Read full news article

Orbit Exports Ltd is Rated Sell

2026-01-24 10:10:15Orbit Exports Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 30 December 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 24 January 2026, providing investors with the most up-to-date insight into the company’s performance and outlook.

Read full news article