Key Events This Week

16 Feb: Death Cross formation signals potential bearish trend

17 Feb: Downgrade to Strong Sell amid weak fundamentals and bearish technicals

20 Feb: Week closes at Rs.4.45 (+1.60%) outperforming Sensex

Mar 05

BSE+NSE Vol: 14.85 k

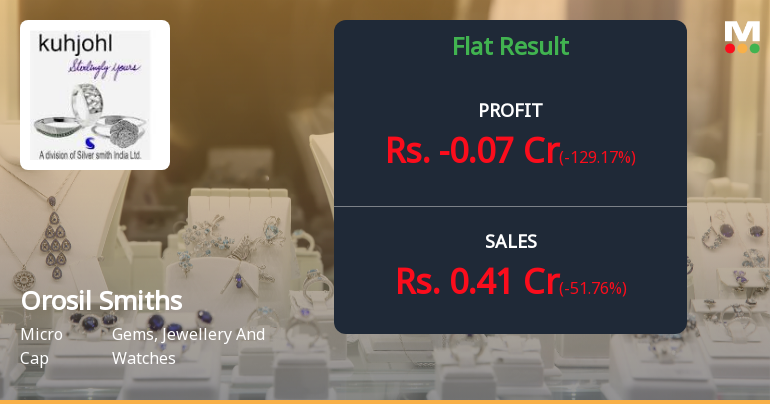

Orosil Smiths India Ltd, a player in the Gems, Jewellery and Watches sector, has been downgraded from a Sell to a Strong Sell rating as of 2 March 2026. This revision reflects a deterioration across multiple key parameters including technical indicators, valuation metrics, financial trends, and overall quality scores, signalling heightened risk for investors despite some positive promoter activity.

Read full news article

16 Feb: Death Cross formation signals potential bearish trend

17 Feb: Downgrade to Strong Sell amid weak fundamentals and bearish technicals

20 Feb: Week closes at Rs.4.45 (+1.60%) outperforming Sensex

Orosil Smiths India Ltd has seen its investment rating upgraded from Strong Sell to Sell as of 25 February 2026, driven primarily by a shift in technical indicators despite persistent fundamental weaknesses. The Gems, Jewellery and Watches sector company’s Mojo Score improved to 33.0, reflecting a more optimistic technical outlook, even as financial trends and valuation metrics remain challenging.

Read full news article

Orosil Smiths India Ltd, a player in the Gems, Jewellery and Watches sector, has seen its investment rating downgraded from Sell to Strong Sell as of 16 Feb 2026. This revision reflects a deterioration in technical indicators, stagnant financial performance, and weak long-term fundamentals, despite a modest uptick in promoter confidence. The company’s current Mojo Score stands at 17.0, underscoring significant caution for investors.

Read full news article

Orosil Smiths India Ltd, a micro-cap player in the Gems, Jewellery And Watches sector, has recently formed a Death Cross, a technical pattern where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting a deterioration in the stock’s medium-term momentum and raising concerns about its long-term price strength.

Read full news articleOrosil Smiths India Ltd's latest financial results for Q2 FY26 present a complex picture of operational performance. The company reported a net profit of ₹0.24 crores, marking a significant turnaround from a loss of ₹0.10 crores in the same quarter last year. Revenue for the quarter surged to ₹0.85 crores, reflecting a remarkable year-on-year growth of 1316.67%. The profit after tax (PAT) margin stood at 28.24%, a notable improvement from the previous year's deeply negative margin. However, a closer examination reveals some underlying concerns. The revenue showed a sequential decline of 3.41% from ₹0.88 crores in the previous quarter (Q1 FY26), indicating potential volatility in sales. Furthermore, the company's reliance on other income, which contributed significantly to the net profit, raises questions about the sustainability of this profitability. The operating profit before depreciation, interest, and...

Read full news article

Orosil Smiths India Ltd., a micro-cap jewellery manufacturer with a market capitalisation of ₹18.00 crores, reported a sharp return to profitability in Q2 FY26 with net profit of ₹0.24 crores, reversing a year-ago loss of ₹0.10 crores. The company's shares closed at ₹4.43 on February 06, 2026, up 2.55% on the day, though the stock remains 22.96% below its 52-week high of ₹5.75, reflecting investor caution about the sustainability of this turnaround.

Read full news articleOrosil Smiths India Ltd's latest financial results for Q2 FY26 reveal a complex operational landscape. The company reported net sales of ₹0.85 crores, which reflects a significant year-on-year growth of 1316.67% from a very low base of ₹0.06 crores in Q2 FY25. However, this figure represents a quarter-on-quarter decline of 3.41% from ₹0.88 crores in Q1 FY26, indicating a loss of momentum in sales. The net profit for the quarter was ₹0.24 crores, marking a substantial increase of 700% compared to the previous quarter's profit of ₹0.03 crores. This increase, while notable, raises concerns as it is heavily reliant on other income, which contributed ₹0.27 crores. The operating profit, excluding other income, was effectively zero, highlighting ongoing challenges in the core jewellery manufacturing operations. The reported PAT margin of 28.24% appears strong but is primarily driven by non-operational income, ra...

Read full news articleThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for B K Narula HUF

The Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for B K Narula HUF

The Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for B K Narula HUF

No Upcoming Board Meetings

No Dividend history available

Orosil Smiths India Ltd has announced 1:5 stock split, ex-date: 24 Aug 17

No Bonus history available

No Rights history available