Key Events This Week

2 Feb: Sharp 4.67% decline on heavy volume

3 Feb: Recovery with 4.01% gain alongside Sensex rally

4 Feb: Continued rally, stock up 4.89%

5 Feb: Intraday low and 7.99% drop amid margin concerns

6 Feb: Valuation upgrade noted despite 3.72% fall

Parag Milk Foods Ltd Valuation Shifts Signal Renewed Price Attractiveness Amid Market Volatility

2026-02-06 08:01:56Parag Milk Foods Ltd has witnessed a notable shift in its valuation parameters, moving from a very attractive to an attractive rating, despite recent market headwinds. This change reflects evolving investor sentiment and a recalibration of price multiples relative to historical averages and peer benchmarks within the FMCG sector.

Read full news articleAre Parag Milk Foods Ltd latest results good or bad?

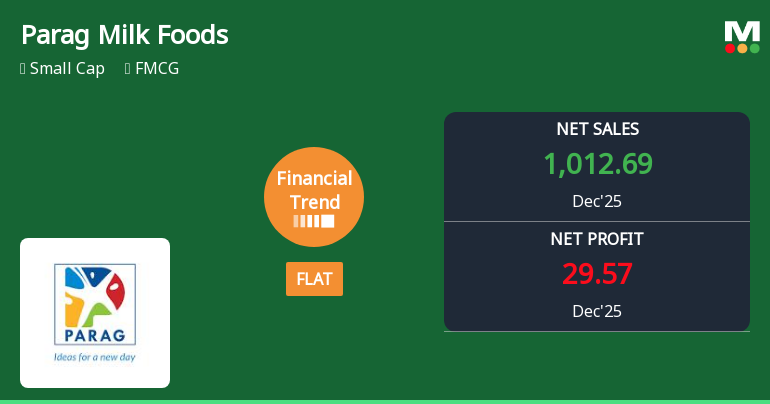

2026-02-05 19:31:58Parag Milk Foods Ltd's latest financial results for Q3 FY26 reveal a complex situation characterized by significant revenue growth but notable challenges in profitability. The company achieved record net sales of ₹1,012.69 crores, reflecting a year-on-year growth of 14.46%. This growth in revenue is a positive indicator of the company's operational momentum. However, it is overshadowed by a substantial decline in net profit, which fell to ₹29.57 crores, representing an 18.02% decrease compared to the same quarter last year and a sharp 35.22% drop from the previous quarter. The operating margin also compressed to 6.74%, marking the lowest level in eight quarters and down from 8.38% in Q3 FY25. This decline in margins suggests rising input costs, competitive pricing pressures, or operational inefficiencies that the company has struggled to manage effectively. The profit after tax (PAT) margin similarly decr...

Read full news article

Parag Milk Foods Ltd Reports Flat Quarterly Performance Amid Margin Pressures

2026-02-05 11:00:22Parag Milk Foods Ltd has reported a flat financial performance for the quarter ended December 2025, signalling a notable shift from its previously positive growth trajectory. Despite record net sales, the company faced margin contraction and a decline in profitability metrics, prompting a downgrade in its Mojo Grade from Hold to Sell.

Read full news article

Parag Milk Foods Q3 FY26: Margin Pressure Clouds Revenue Growth Story

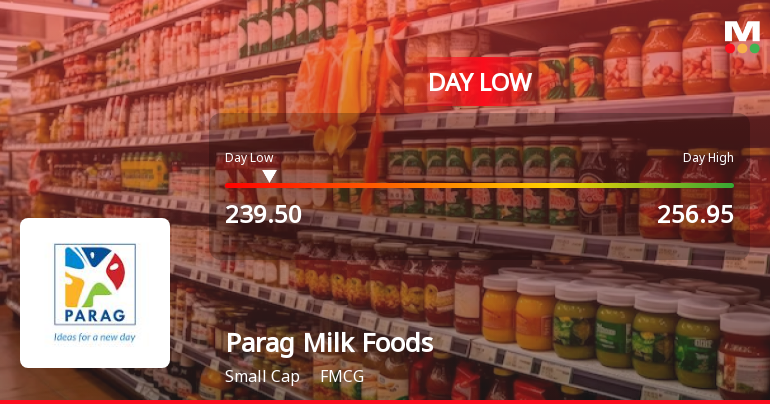

2026-02-05 09:54:19Parag Milk Foods Ltd., a small-cap FMCG player with a market capitalisation of ₹3,013.26 crores, reported a challenging third quarter for FY26, with net profit declining 35.22% quarter-on-quarter to ₹29.57 crores despite marginal revenue growth. The stock plunged 8.35% to ₹240.85 following the results announcement, reflecting investor disappointment over deteriorating profitability metrics and compressed operating margins.

Read full news article

Parag Milk Foods Ltd Hits Intraday Low Amid Price Pressure on 5 Feb 2026

2026-02-05 09:32:47Parag Milk Foods Ltd experienced a significant intraday decline on 5 Feb 2026, touching a low of Rs 244.35, reflecting intense price pressure and heightened volatility. The stock underperformed its FMCG sector peers and broader market indices, continuing a downward trend after two days of gains.

Read full news article

Parag Milk Foods Ltd is Rated Hold

2026-02-01 10:10:56Parag Milk Foods Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 20 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Parag Milk Foods Ltd is Rated Hold

2026-01-21 10:10:53Parag Milk Foods Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 20 Oct 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 21 January 2026, providing investors with an up-to-date perspective on the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Parag Milk Foods Ltd is Rated Hold

2026-01-10 10:10:49Parag Milk Foods Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 20 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 10 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article