Key Events This Week

2 Feb: Stock opens with a 2.47% gain despite Sensex decline

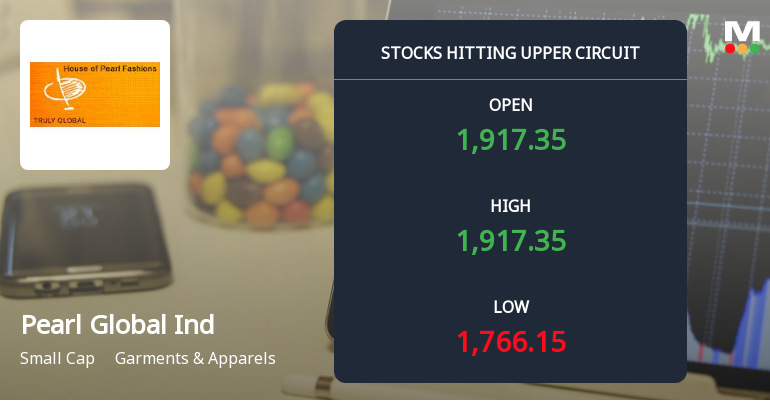

3 Feb: Intraday high and upper circuit hit with 17.16% surge

4 Feb: Intraday high with 8.25% gain amid sector outperformance

5 Feb: Minor correction with 2.05% decline

6 Feb: Week closes at Rs.1,834.60, down 2.24% on day but up 17.66% weekly