Key Events This Week

Jan 27: Stock rallies 2.32% on strong volume

Jan 28: Reports multibagger returns and stellar Q2 results; stock drops 3.98%

Jan 29: Intraday low hit amid heavy selling; closes down 1.28%

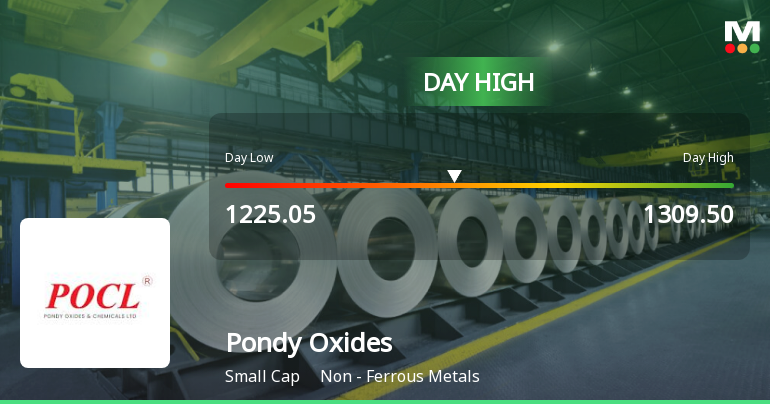

Jan 30: Sharp decline of 4.69% closes the week at Rs.1,189.05