Prelude Therapeutics Experiences Revision in Its Stock Evaluation Amid Mixed Financial Trends

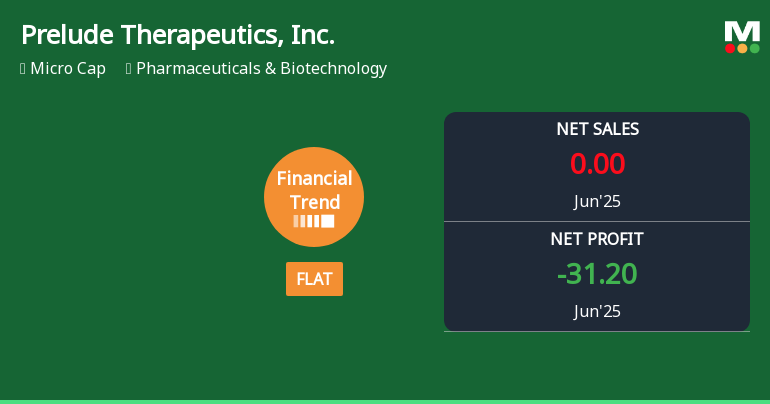

2025-11-19 15:43:57Prelude Therapeutics, Inc. has reported a mixed financial performance for the quarter ending June 2025, with increased net profit and sales but significant challenges in operating cash flow and return on capital employed. Despite these hurdles, the company has outperformed the S&P 500 over the past year.

Read full news articleNo announcement available

Corporate Actions

No corporate action available