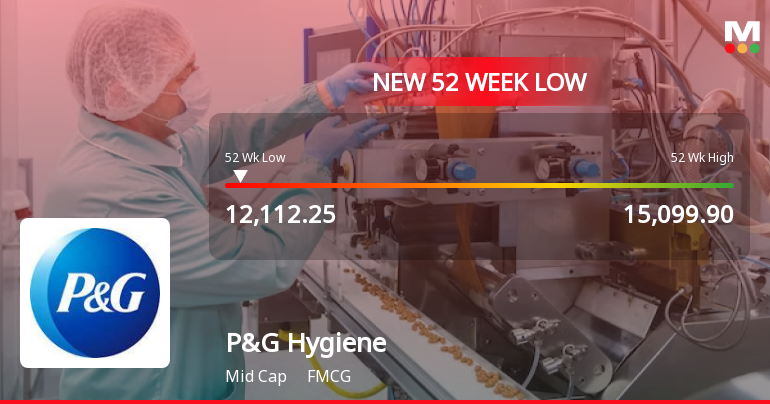

Procter & Gamble Hygiene & Health Care Ltd. Stock Hits 52-Week Low at Rs.11730

2026-01-29 12:21:02Procter & Gamble Hygiene & Health Care Ltd. has declined to a fresh 52-week low of Rs.11730, marking a significant downturn in its stock performance amid broader market fluctuations and company-specific valuation concerns.

Read full news article

Procter & Gamble Hygiene & Health Care Ltd. Stock Hits 52-Week Low at Rs.12000

2026-01-20 11:10:28Procter & Gamble Hygiene & Health Care Ltd. has touched a new 52-week low of Rs.12000 today, marking a significant decline amid broader market fluctuations and sectoral underperformance. The stock has been on a downward trajectory, reflecting a combination of valuation concerns and recent financial trends.

Read full news article

Procter & Gamble Hygiene & Health Care Ltd. is Rated Sell

2026-01-20 10:10:43Procter & Gamble Hygiene & Health Care Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 07 Oct 2024. However, the analysis and financial metrics discussed here reflect the stock's current position as of 20 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Procter & Gamble Hygiene & Health Care Ltd. Stock Hits 52-Week Low at Rs.12,118.4

2026-01-19 11:42:22Procter & Gamble Hygiene & Health Care Ltd. has declined to a fresh 52-week low of Rs.12,118.4, marking a significant downturn amid broader market fluctuations and persistent underperformance relative to its sector and benchmark indices.

Read full news article

Procter & Gamble Hygiene & Health Care Ltd. is Rated Sell

2026-01-09 10:10:44Procter & Gamble Hygiene & Health Care Ltd. is rated Sell by MarketsMOJO. This rating was last updated on 07 October 2024. However, the analysis and financial metrics presented here reflect the stock's current position as of 09 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Procter & Gamble Hygiene & Health Care Ltd. Faces Bearish Momentum Amid Technical Downturn

2026-01-05 08:07:22Procter & Gamble Hygiene & Health Care Ltd. has experienced a notable shift in price momentum, with technical indicators signalling a bearish trend across multiple timeframes. The company’s stock price has declined modestly in recent sessions, reflecting deteriorating market sentiment amid broader FMCG sector dynamics and relative underperformance against benchmark indices.

Read full news article

Procter & Gamble Hygiene & Health Care Ltd: Technical Momentum Shifts Amid Mixed Market Signals

2026-01-02 08:12:18Procter & Gamble Hygiene & Health Care Ltd. (P&G Hygiene) has experienced a subtle shift in its technical momentum as of early January 2026, with key indicators signalling a transition from bearish to mildly bearish territory. Despite a modest day gain of 0.56%, the stock’s technical parameters reveal a complex picture of mixed signals across weekly and monthly timeframes, prompting a cautious stance among investors.

Read full news article

Procter & Gamble Hygiene & Health Care Ltd. is Rated Sell

2025-12-28 10:10:03Procter & Gamble Hygiene & Health Care Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 07 Oct 2024. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

P&G Hygiene Sees Revision in Market Evaluation Amidst Challenging FMCG Landscape

2025-12-17 10:10:20P&G Hygiene’s market evaluation has undergone a revision reflecting shifts in its fundamental and technical outlook. The company, positioned within the FMCG sector as a midcap entity, faces a complex environment marked by valuation concerns and subdued financial momentum, influencing its recent assessment.

Read full news articleUpdate on board meeting

21-Jan-2026 | Source : BSEProcter & Gamble Hygiene And Health Care Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 30/01/2026 inter alia to consider and approve The Company has submitted an update on Board Meeting scheduled to be held on January 30 2026

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

13-Jan-2026 | Source : BSEThe Company has submitted Certificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended December 31 2025

Closure of Trading Window

26-Dec-2025 | Source : BSEThe Company has informed the Exchange about the closure of trading window for the quarter ending December 31 2025

Corporate Actions

(30 Jan 2026)

Procter & Gamble Hygiene & Health Care Ltd. has declared 650% dividend, ex-date: 28 Aug 25

No Splits history available

No Bonus history available

No Rights history available