Is Provident Bancorp, Inc. (Massachusetts) overvalued or undervalued?

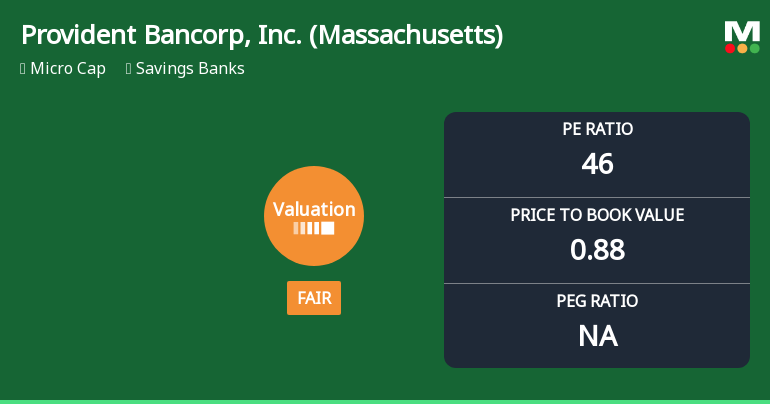

2025-10-21 12:12:03As of 17 October 2025, the valuation grade for Provident Bancorp, Inc. has moved from expensive to fair. The company appears to be fairly valued based on its current metrics. Key ratios include a P/E ratio of 46, a Price to Book Value of 0.88, and an EV to EBITDA of 35.84. When compared to peers, Southern Missouri Bancorp, Inc. has a P/E of 11.64, while Hingham Institution for Savings has a P/E of 18.15, indicating that Provident Bancorp is priced higher relative to these competitors. In terms of stock performance, Provident Bancorp's year-to-date return of 9.21% lags behind the S&P 500's return of 13.30%, reflecting a challenging market position....

Read MoreIs Provident Bancorp, Inc. (Massachusetts) overvalued or undervalued?

2025-10-20 12:29:19As of 17 October 2025, the valuation grade for Provident Bancorp, Inc. has moved from expensive to fair, indicating a more favorable assessment of its current market position. The company appears to be fairly valued, with a P/E ratio of 46, a Price to Book Value of 0.88, and an EV to EBIT of 42.22. In comparison to its peers, Southern Missouri Bancorp, Inc. has a much lower P/E ratio of 11.64, while Hingham Institution for Savings stands at 18.15, highlighting that Provident Bancorp is priced significantly higher than these competitors. Despite the fair valuation, the company's recent stock performance has been mixed, with a year-to-date return of 9.21% compared to the S&P 500's 13.30%. Over the longer term, however, Provident Bancorp has shown a 53.51% return over the past five years, which is notably lower than the S&P 500's 91.29% during the same period, suggesting that while the stock is currently fair...

Read MoreIs Provident Bancorp, Inc. (Massachusetts) overvalued or undervalued?

2025-10-19 12:06:45As of 17 October 2025, the valuation grade for Provident Bancorp, Inc. has moved from expensive to fair. The company appears to be fairly valued based on its current metrics. Key ratios include a P/E ratio of 46, a price to book value of 0.88, and an EV to EBITDA of 35.84. In comparison, Southern Missouri Bancorp, Inc. has a P/E of 11.64, indicating a more attractive valuation, while Hingham Institution for Savings has a P/E of 18.15, also suggesting a relatively better position. In terms of recent performance, Provident Bancorp's year-to-date return of 9.21% trails the S&P 500's return of 13.30%, and over the past three years, it has significantly underperformed with a return of -17.39% compared to the S&P 500's 81.19%. This underperformance reinforces the notion that while the stock is currently fairly valued, it may not be the best investment choice compared to its peers and the broader market....

Read More

Provident Bancorp, Inc. Experiences Revision in Its Stock Evaluation Amid Market Dynamics

2025-10-13 16:05:26Provident Bancorp, Inc., a Massachusetts-based savings bank, recently adjusted its valuation, with its stock priced at $12.30. Over the past year, it has achieved a 19.77% return, surpassing the S&P 500. Key metrics include a P/E ratio of 46 and a price-to-book value of 0.88, reflecting a cautious market stance compared to peers.

Read MoreIs Provident Bancorp, Inc. (Massachusetts) overvalued or undervalued?

2025-10-12 11:09:13As of 10 October 2025, the valuation grade for Provident Bancorp, Inc. has moved from expensive to fair. Based on the analysis, the company appears to be fairly valued at this time. Key valuation ratios include a P/E ratio of 46, a Price to Book Value of 0.88, and an EV to EBIT of 42.22. In comparison to its peers, Southern Missouri Bancorp, Inc. has a P/E of 11.64, while Hingham Institution for Savings has a P/E of 18.15, indicating that Provident Bancorp is trading at a premium relative to these competitors. Notably, the company's stock has outperformed the S&P 500 over the past year, returning 19.77% compared to the index's 13.36%, but has significantly lagged over the longer three and five-year periods....

Read More