Valuation Metrics Paint a Cautionary Picture

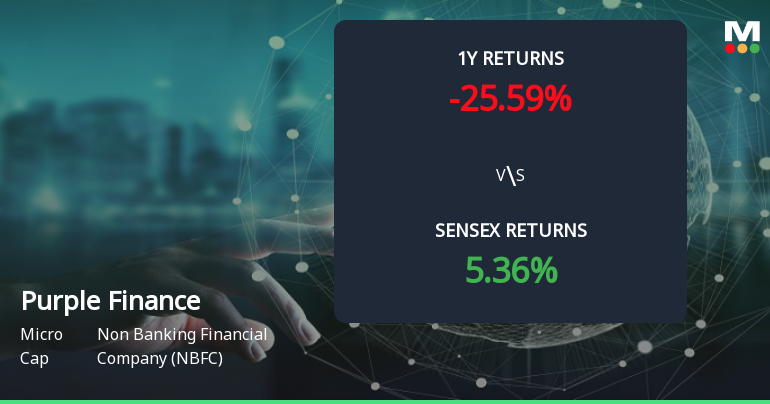

As of early December 2025, Purple Finance’s valuation grade shifted from "risky" to "very expensive," signalling heightened market expectations. The company’s price-to-earnings (PE) ratio stands at a negative figure, reflecting losses rather than profits, which complicates traditional valuation comparisons. A negative PE ratio of approximately -19.6 indicates that Purple Finance is currently unprofitable, a red flag for many investors.

Further, the enterprise value to EBITDA (EV/EBITDA) ratio is deeply negative, around -38.8, reinforcing the notion of operational challenges. The price-to-book (P/B) ratio, however, is 2.20, which is moderately elevated but not extreme in the NBFC sector context. This suggests the market value...

Read full news article