Key Events This Week

16 Feb: Rating downgraded to Buy amid mixed financial and technical signals

18 Feb: Valuation turns very attractive amid market volatility

20 Feb: Week closes at Rs.4.93 (-4.46%) vs Sensex +0.39%

Mar 05

BSE+NSE Vol: 11.74 lacs

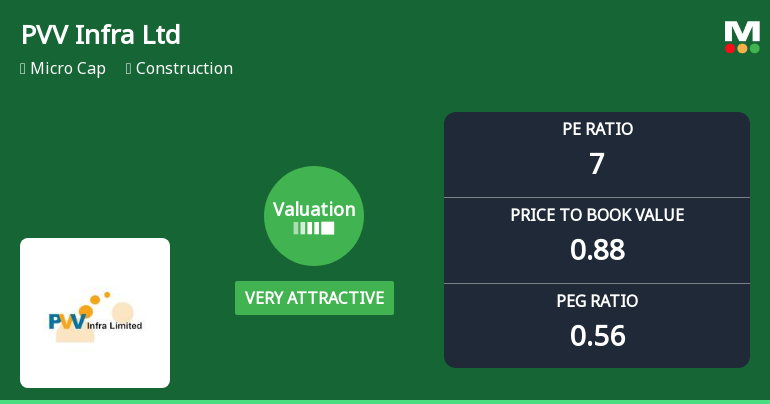

PVV Infra Ltd, a key player in the construction sector, has seen its valuation parameters improve significantly, shifting from an already attractive level to a very attractive status. This change comes amid a backdrop of mixed market performance and evolving sector dynamics, prompting investors to reassess the stock’s price attractiveness relative to its historical and peer benchmarks.

Read full news article

16 Feb: Rating downgraded to Buy amid mixed financial and technical signals

18 Feb: Valuation turns very attractive amid market volatility

20 Feb: Week closes at Rs.4.93 (-4.46%) vs Sensex +0.39%

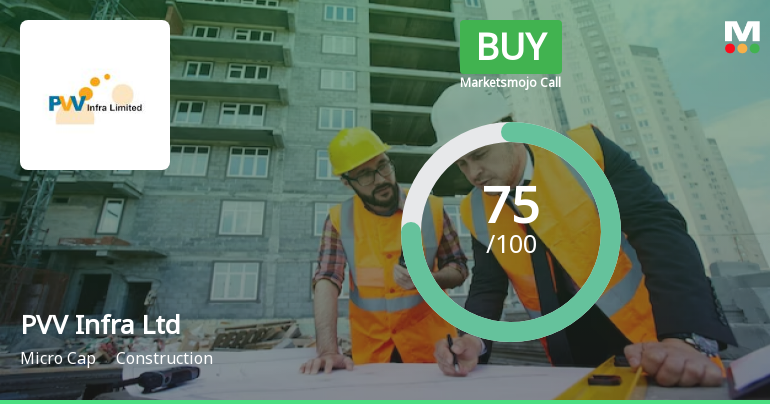

PVV Infra Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 16 February 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 March 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

PVV Infra Ltd, a key player in the construction sector, has witnessed a notable shift in its valuation parameters, moving from a very attractive to a fair valuation grade. This change reflects evolving market perceptions amid fluctuating financial metrics and peer comparisons, prompting investors to reassess the stock’s price attractiveness in the context of broader sector trends and historical benchmarks.

Read full news article

PVV Infra Ltd, a key player in the construction sector, has seen its valuation parameters shift markedly, moving from a fair to a very attractive rating. Despite a recent dip in share price, the company’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios now position it favourably against peers and historical averages, signalling a potential opportunity for investors seeking value in a volatile market.

Read full news article

PVV Infra Ltd’s investment rating has been downgraded from Strong Buy to Buy following a comprehensive reassessment of its financial performance, valuation metrics, quality indicators, and technical outlook. Despite outstanding quarterly results, shifts in valuation and technical signals have prompted a more cautious stance from analysts, reflecting a nuanced view of the company’s prospects in the construction sector.

Read full news article

Feb 9: Valuation concerns emerge as P/E and P/BV ratios rise

Feb 10: Stellar Q3 FY26 results reveal 3,408% profit surge

Feb 11: Outstanding quarterly performance amid sector recovery

Feb 12: Quality grade upgraded to average; Mojo Score rises to 80.0

Feb 13: Strong Buy rating confirmed following robust financial improvements

PVV Infra Ltd has been upgraded from a Hold to a Strong Buy rating following a comprehensive reassessment of its financial performance, valuation metrics, quality indicators, and technical outlook. The upgrade reflects the company’s outstanding quarterly results, improved growth trajectory, and attractive valuation relative to peers, signalling renewed investor confidence in this construction sector player.

Read full news article

PVV Infra Ltd, a key player in the construction sector, has seen its quality grading upgraded from below average to average, prompting MarketsMOJO to raise its rating from Hold to Strong Buy. This upgrade reflects significant improvements in the company’s financial fundamentals, including enhanced return ratios, manageable debt levels, and consistent growth metrics, positioning it favourably against peers and the broader market.

Read full news articleRights Issue

The Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Apple Equifin Pvt Ltd

Rights issue

No Upcoming Board Meetings

No Dividend history available

PVV Infra Ltd has announced 5:10 stock split, ex-date: 26 Sep 25

PVV Infra Ltd has announced 1:1 bonus issue, ex-date: 20 Aug 24

PVV Infra Ltd has announced 6:7 rights issue, ex-date: 05 Feb 26