Key Events This Week

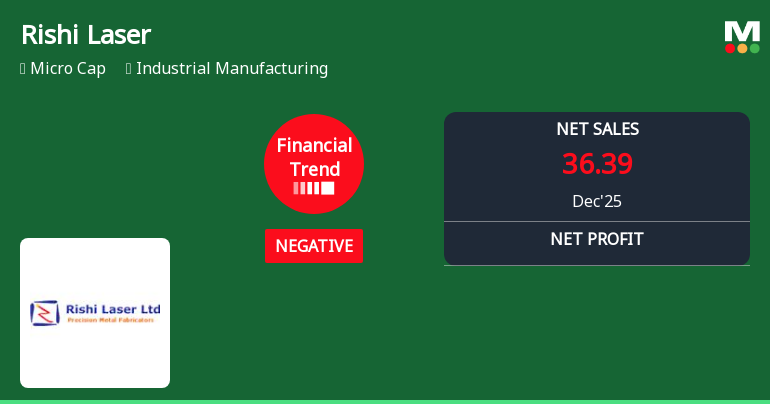

16 Feb: Sharp quarterly decline reported; stock drops 5.34%

17 Feb: Continued price fall of 6.14% amid weak sentiment

18 Feb: Minor recovery of 0.87% as market stabilises

19 Feb: Slight dip of 0.76% on weak Sensex day

20 Feb: Modest gain of 1.06% closes the week