Key Events This Week

Feb 09: Stock opens strong at Rs.39.10, up 3.30%

Feb 12: Q3 FY26 results reveal flat revenue and mounting losses

Feb 13: Technical upgrade to Sell rating announced; stock closes at Rs.40.88 (+2.40%)

Weekly Summary: Stock gains 8.01% vs Sensex decline of 0.54%

Sainik Finance & Industries Ltd Upgraded to Sell on Technical Improvements

2026-02-13 08:08:08Sainik Finance & Industries Ltd has seen its investment rating upgraded from Strong Sell to Sell, reflecting a nuanced shift in its technical outlook despite persistent fundamental challenges. The change, effective from 12 Feb 2026, is primarily driven by improvements in technical indicators, while valuation and financial trends remain mixed. This article analyses the four key parameters—Quality, Valuation, Financial Trend, and Technicals—that influenced this rating revision.

Read full news articleAre Sainik Finance & Industries Ltd latest results good or bad?

2026-02-12 19:38:26The latest financial results for Sainik Finance & Industries Ltd reveal significant challenges, particularly in Q3 FY26. The company reported net sales of negative ₹1.29 crores, indicating that it is experiencing more sales returns, discounts, or reversals than actual sales. This marks a stark contrast to the positive net sales of ₹5.82 crores reported in Q2 FY26. The operational performance has deteriorated sharply, with a net loss of ₹8.87 crores in Q3 FY26, a drastic swing from a small profit of ₹0.18 crores in the previous quarter. The operating margin, although reported at 465.89%, is distorted due to the negative sales figure, rendering it largely meaningless. The company’s interest burden remains high at ₹4.40 crores, further straining its profitability amidst collapsing operational performance. The profit before tax also reflects this trend, showing a substantial loss of ₹10.23 crores compared to a...

Read full news article

Sainik Finance & Industries Q3 FY26: Micro-Cap Cement Player Struggles with Negative Revenue and Mounting Losses

2026-02-12 17:30:54Sainik Finance & Industries Ltd., a micro-cap player in the cement and cement products sector, reported deeply troubling quarterly results for Q3 FY26 (December 2025 quarter), with net sales of negative ₹1.29 crores and a consolidated net loss of ₹8.87 crores. The company, with a market capitalisation of just ₹42.00 crores, continues to struggle with operational viability, posting its second consecutive quarter of negative revenue. Following the results, the stock traded at ₹39.91 on February 12, 2026, down 37.64% from its 52-week high of ₹64.00, though it has gained 3.69% in the most recent trading session.

Read full news articleWhen is the next results date for Sainik Finance & Industries Ltd?

2026-02-05 23:17:08The next results date for Sainik Finance & Industries Ltd is scheduled for 12 February 2026....

Read full news article

Sainik Finance & Industries Ltd Downgraded to Strong Sell Amid Weak Fundamentals and Bearish Technicals

2026-02-04 08:12:03Sainik Finance & Industries Ltd has been downgraded from a Sell to a Strong Sell rating as of 3 February 2026, reflecting deteriorating technical indicators and persistently weak financial performance. Despite a modest uptick in share price, the company’s long-term fundamentals and valuation metrics continue to raise concerns for investors.

Read full news article

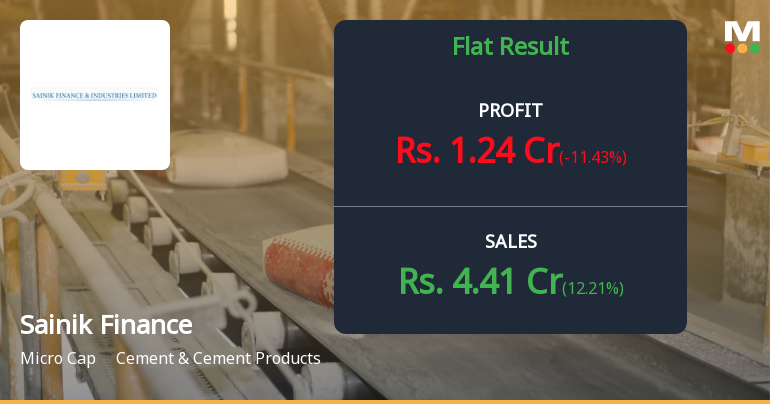

Sainik Finance & Industries Ltd Upgraded to Sell on Technical Improvements Despite Flat Financials

2026-01-30 08:05:29Sainik Finance & Industries Ltd has seen its investment rating upgraded from Strong Sell to Sell as of 29 Jan 2026, driven primarily by a shift in technical indicators despite persistent fundamental challenges. The company’s technical trend has improved from bearish to mildly bearish, prompting a reassessment of its outlook. However, underlying financial performance remains subdued, with flat quarterly results and weak long-term growth metrics continuing to weigh on investor sentiment.

Read full news article