Recent Price Movement and Market Context

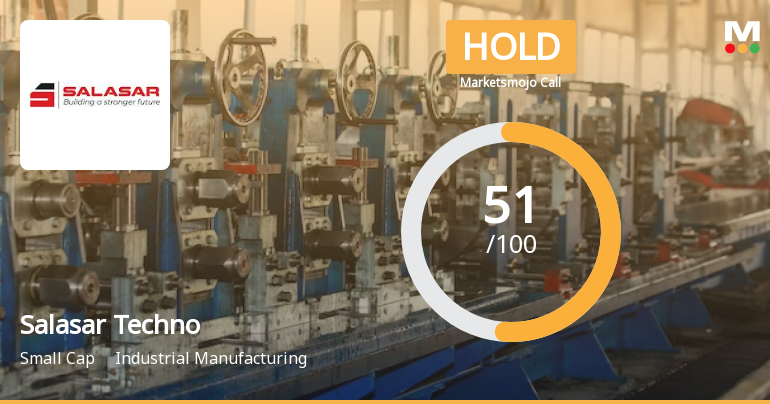

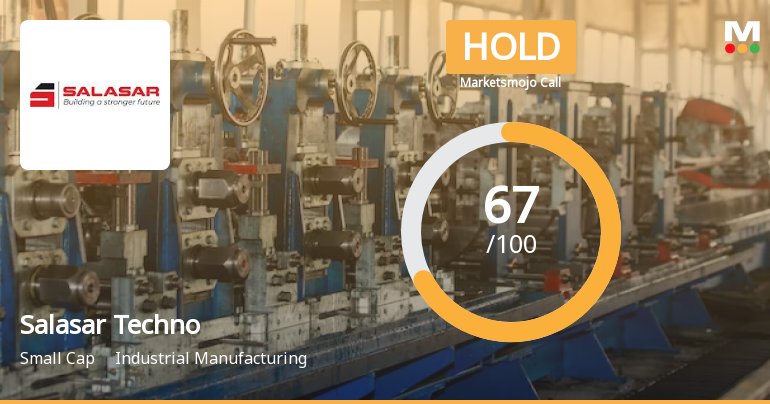

On 20 January, Salasar Techno Engineering Ltd’s share price closed at ₹8.02, down by ₹0.45 or 5.31% from the previous session. This decline is more pronounced than the Engineering - Industrial Equipments sector, which itself fell by 2.33% on the same day. The stock underperformed its sector by nearly 3 percentage points, signalling a lack of investor confidence relative to peers. Furthermore, the stock is trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, indicating a sustained bearish trend in the short to long term.

Investor participation has also waned, with delivery volumes on 19 January dropping by 31.92% compared to the five-day average. This decline in trading activi...

Read full news article