Recent Price Movement and Market Behaviour

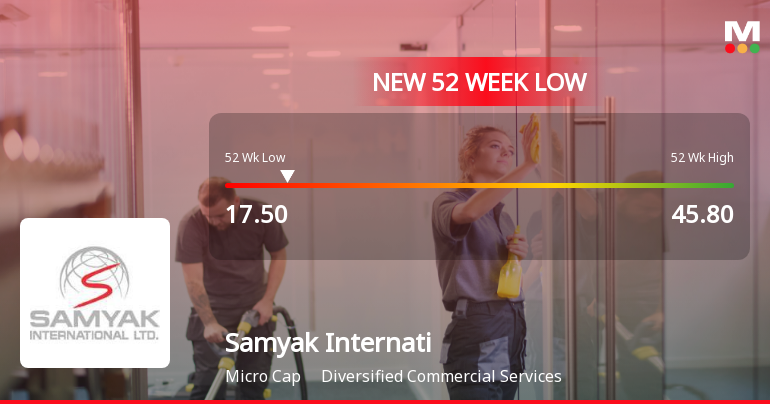

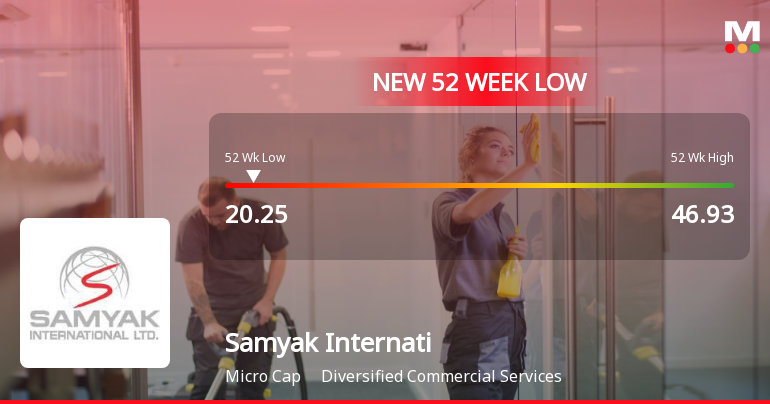

The stock opened sharply lower on 12-Dec, with a gap down of 4.35%, signalling immediate selling pressure from the outset of trading. Despite touching an intraday high of ₹23.99, representing a 4.3% rise from the previous close, the share ultimately succumbed to bearish momentum, hitting an intraday low of ₹21.7, down 5.65%. The wide trading range of ₹2.29 during the session indicates heightened volatility and uncertainty among investors.

Notably, the weighted average price suggests that a larger volume of shares exchanged hands closer to the day’s low, underscoring the dominance of sellers throughout the trading day. This selling pressure was further evidenced by the stock trading below all key moving averages, including the ...

Read full news article