Key Events This Week

2 Feb: Death Cross formation signals bearish trend

3 Feb: Bearish momentum intensifies with technical downturn

5 Feb: Technical momentum shifts to mildly bearish amid 4.06% gain

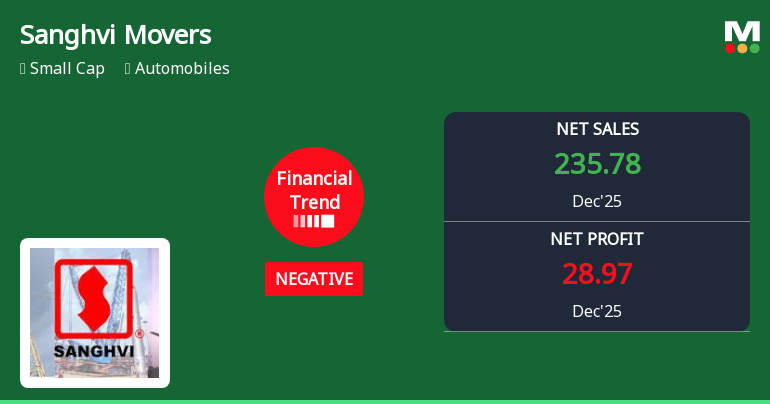

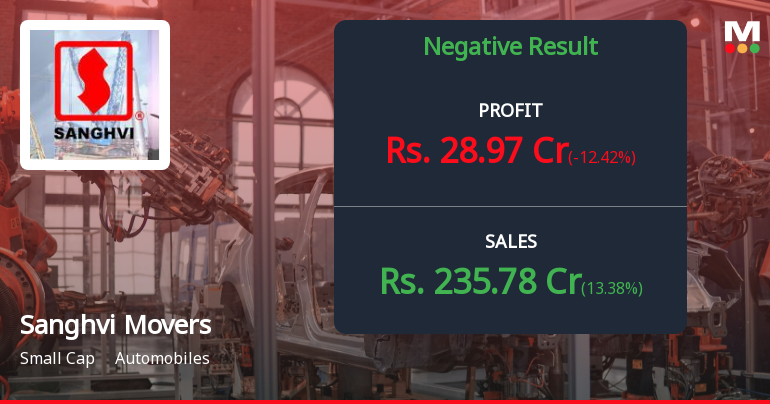

6 Feb: Q3 FY26 results reveal margin pressure despite revenue growth

Are Sanghvi Movers Ltd latest results good or bad?

2026-02-07 19:20:08Sanghvi Movers Ltd's latest financial results for Q3 FY26 present a complex picture of the company's performance. On a year-on-year basis, the company reported a net profit of ₹36.27 crores, reflecting a growth of 24.55%, while net sales reached ₹209.90 crores, marking a significant increase of 34.44%. These figures indicate a robust recovery compared to the previous year, driven by increased crane deployment and favorable industry dynamics. However, the sequential performance reveals challenges, with net sales declining by 23.21% from the previous quarter and net profit falling by 27.84%. This suggests potential cyclicality in project execution or operational headwinds that may be impacting the company's short-term performance. The operating margin improved to 38.49% from the previous quarter, but it remains significantly lower than the 46.86% achieved in the same quarter last year, indicating ongoing pre...

Read full news article

Sanghvi Movers Q3 FY26: Margin Pressure and Sequential Decline Overshadow Revenue Growth

2026-02-06 19:01:45Sanghvi Movers Ltd., India's largest crane rental company, reported a mixed third quarter for fiscal year 2026, with net profit declining 27.84% quarter-on-quarter to ₹36.27 crores despite robust year-on-year growth. The small-cap company, commanding a market capitalisation of ₹2,772 crores, witnessed its stock decline 2.30% to ₹320.10 following the results announcement, reflecting investor concerns over deteriorating profitability metrics and margin compression.

Read full news article

Sanghvi Movers Ltd Technical Momentum Shifts Amid Mixed Market Signals

2026-02-05 08:00:58Sanghvi Movers Ltd, a key player in the Indian automobile sector, has experienced a notable shift in its technical parameters, reflecting a complex interplay of bullish and bearish signals. Despite a recent 4.06% gain in daily price, the stock’s technical indicators present a nuanced picture that investors should carefully analyse amid evolving market dynamics.

Read full news article

Sanghvi Movers Ltd Faces Bearish Momentum Amid Technical Downturn

2026-02-03 08:01:06Sanghvi Movers Ltd has experienced a notable shift in its technical momentum, transitioning from a sideways trend to a bearish outlook. Recent technical indicators, including MACD, RSI, and moving averages, signal increasing downside pressure, prompting a downgrade in its Mojo Grade from Hold to Sell as of 12 Jan 2026. This article analyses the evolving price dynamics and technical signals shaping investor sentiment towards this automobile sector stock.

Read full news article

Sanghvi Movers Ltd Forms Death Cross Signalling Bearish Trend Ahead

2026-02-02 18:05:32Sanghvi Movers Ltd, a key player in the automobile sector, has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting deteriorating momentum and raising concerns about the stock's medium to long-term outlook.

Read full news article

Sanghvi Movers Ltd is Rated Sell

2026-02-02 10:10:47Sanghvi Movers Ltd is rated Sell by MarketsMOJO. This rating was last updated on 12 January 2026, reflecting a shift from the previous Hold stance. However, the analysis and financial metrics discussed here represent the stock's current position as of 02 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Sanghvi Movers Ltd Technical Momentum Shifts Amid Mixed Market Signals

2026-02-02 08:01:19Sanghvi Movers Ltd, a key player in the Indian automobile sector, has experienced a notable shift in its technical momentum, moving from a mildly bearish stance to a sideways trend. Despite a recent downgrade from Hold to Sell by MarketsMOJO, the stock exhibits a complex interplay of technical indicators, signalling both caution and potential opportunities for investors.

Read full news article