Recent Price Movement and Market Context

Sanmit Infra Ltd’s shares have been on a downward trajectory, losing 4.14% over the past week while the Sensex gained 0.31% in the same period. The stock’s decline is even more pronounced over longer horizons, with a one-month loss of 9.68% compared to the Sensex’s 2.51% drop, and a year-to-date fall of 10.28% against the benchmark’s 3.11% decline. Over the last year, the stock has plummeted by 41.00%, starkly contrasting with the Sensex’s 7.88% gain. This trend extends further back, with a three-year loss of 91.39% versus a 39.16% rise in the Sensex, underscoring sustained underperformance.

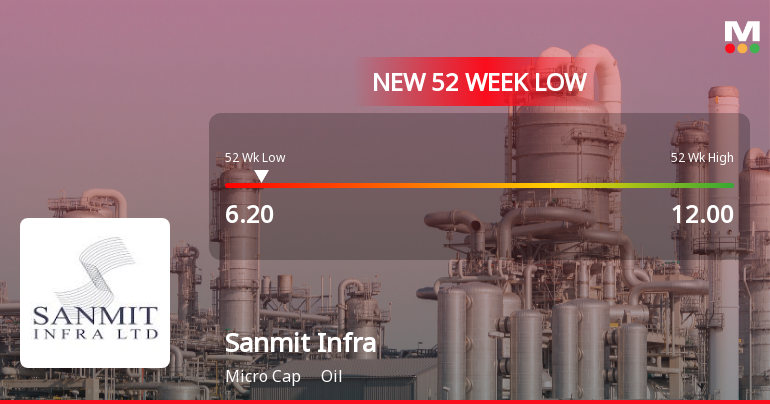

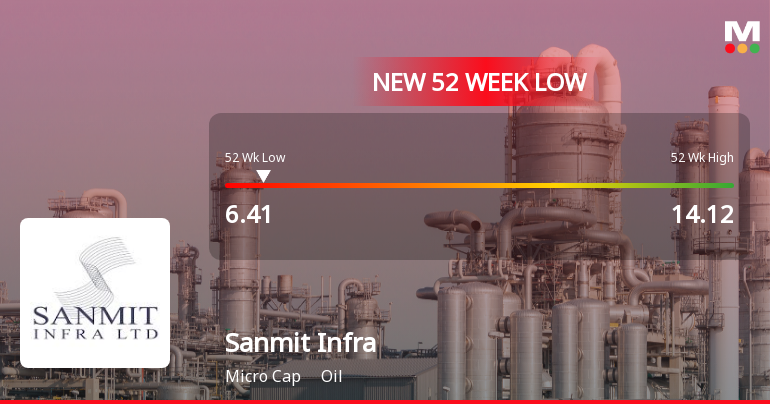

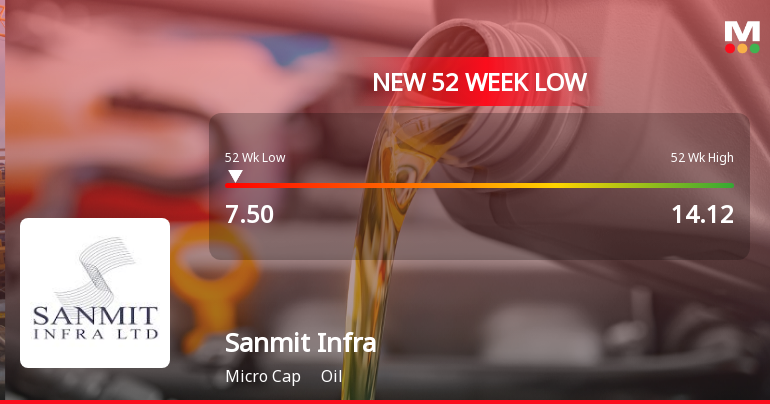

On 29-Jan, the stock closed just 4.61% above its 52-week low of ₹6.41, signalling proximity to its lowest valuation in a year. The share pr...

Read full news article