Key Events This Week

2 Feb: Stock opens at Rs.187.25, down 0.98% amid broad market weakness

4 Feb: Intraday high of Rs.202.6 with a 7.16% surge

5 Feb: Intraday high of Rs.218.0, surging 7.69% and marking third consecutive gain

6 Feb: Q3 FY26 results released; stock closes at Rs.215.40, down 1.46%

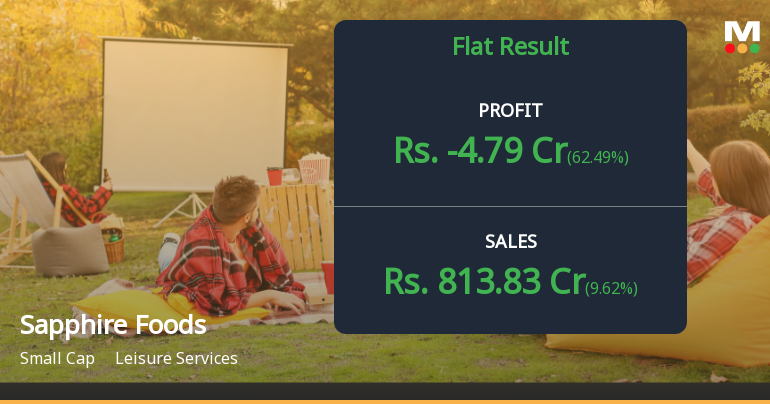

Sapphire Foods Q3 FY26: Losses Deepen Amid Margin Pressures Despite Revenue Growth

2026-02-06 18:23:38Sapphire Foods India Limited, the operator of KFC and Pizza Hut franchises across India, Sri Lanka, and the Maldives, reported disappointing Q3 FY26 results with consolidated net losses widening to ₹4.79 crores compared to a profit of ₹11.98 crores in Q3 FY25, marking a sharp 139.98% year-on-year decline. Despite posting its highest-ever quarterly revenue of ₹813.83 crores, the company's inability to translate top-line growth into bottom-line profitability has raised serious concerns about operational efficiency and margin sustainability.

Read full news article

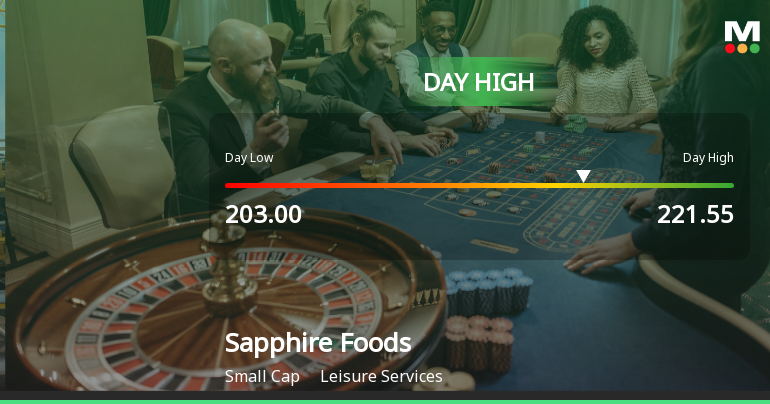

Sapphire Foods India Ltd Hits Intraday High with 7.69% Surge on 5 Feb 2026

2026-02-05 15:16:40Sapphire Foods India Ltd demonstrated robust intraday performance on 5 Feb 2026, surging to an intraday high of Rs 218, marking a 7.52% increase and outperforming its sector and the broader market. The stock’s strong momentum continued its three-day winning streak, delivering a cumulative return of 15.78% over this period.

Read full news article

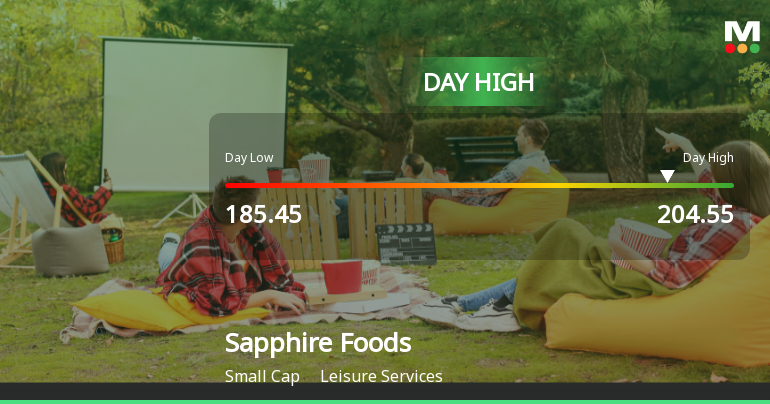

Sapphire Foods India Ltd Hits Intraday High with 7.0% Surge on 4 Feb 2026

2026-02-04 13:16:11Sapphire Foods India Ltd demonstrated robust intraday strength on 4 Feb 2026, surging to a day’s high of Rs 202.6, marking a 7.08% increase. This strong performance outpaced the Leisure Services sector and the broader market, reflecting notable trading momentum despite a subdued Sensex environment.

Read full news article

Sapphire Foods India Ltd is Rated Strong Sell

2026-02-03 10:16:54Sapphire Foods India Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 31 December 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 03 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news articleSapphire Foods India Ltd Gains 2.22%: Key Events and Market Dynamics This Week

2026-01-31 11:02:33

Key Events This Week

27 Jan: Stock hits all-time low at Rs.179.45 amid prolonged downtrend

28 Jan: Sharp rebound with a 5.10% gain to Rs.190.80

29 Jan: Profit-taking leads to 4.51% decline to Rs.182.20

30 Jan: Recovery continues with 3.79% rise to Rs.189.10

Sapphire Foods India Ltd Falls to 52-Week Low Amid Continued Downtrend

2026-01-27 10:48:03Sapphire Foods India Ltd has reached a new 52-week low of Rs.179.45, marking a significant decline amid persistent downward momentum. The stock has underperformed its sector and broader market indices, reflecting ongoing financial pressures and subdued profitability metrics.

Read full news article

Sapphire Foods India Ltd Hits All-Time Low Amid Prolonged Downtrend

2026-01-27 09:36:37Sapphire Foods India Ltd has reached a new all-time low of Rs.179.45, marking a significant decline amid sustained negative returns and underperformance relative to the broader market and its sector peers.

Read full news articleBoard Meeting Outcome for Outcome Of Board Meeting

06-Feb-2026 | Source : BSEOutcome of Board Meeting

Announcement under Regulation 30 (LODR)-Investor Presentation

06-Feb-2026 | Source : BSESapphire Foods India Limited has informed Exchange regarding Investor Presentation

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

06-Feb-2026 | Source : BSESapphire Foods India Limited has informed Exchange about Link of Recording

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Sapphire Foods India Ltd has announced 2:10 stock split, ex-date: 05 Sep 24

No Bonus history available

No Rights history available