Key Events This Week

23 Feb: Downgrade to Strong Sell amid technical and financial weakness; stock falls 6.09% to ₹108.00

25 Feb: Surges to upper circuit with 19.97% gain, closing at ₹121.05

26 Feb: Continues rally, rising 14.21% to ₹138.25

27 Feb: Upgraded to Sell on technical improvements; stock retreats 7.34% to ₹128.10

Secmark Consultancy Ltd Upgraded to Sell on Technical Improvements Despite Profit Decline

2026-02-27 08:09:42Secmark Consultancy Ltd has seen its investment rating upgraded from Strong Sell to Sell as of 26 Feb 2026, driven primarily by a shift in technical indicators despite ongoing challenges in profitability and sales. This nuanced change reflects a complex interplay of quality, valuation, financial trends, and technical factors that investors should carefully consider.

Read full news article

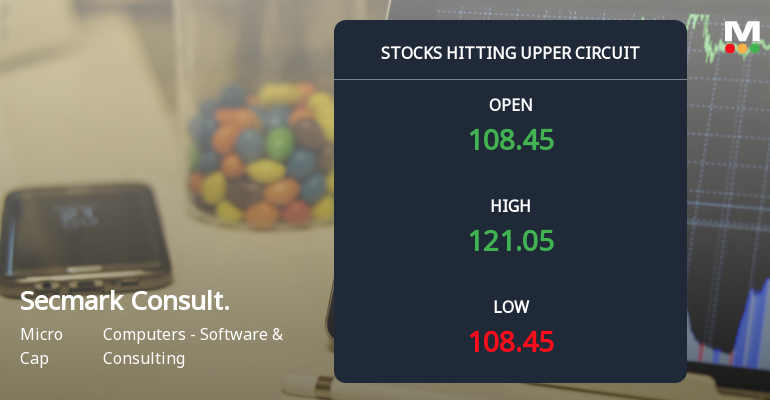

Secmark Consultancy Ltd Surges to Upper Circuit on Robust Buying Momentum

2026-02-25 13:00:13Secmark Consultancy Ltd, a micro-cap player in the Computers - Software & Consulting sector, surged to hit its upper circuit limit of 20% on 25 Feb 2026, closing at ₹122.04. This sharp rally was driven by robust buying interest, a significant volume uptick, and a wide intraday price range, signalling renewed investor confidence despite the company’s current strong sell rating.

Read full news article

Secmark Consultancy Ltd Downgraded to Strong Sell Amid Technical and Financial Weakness

2026-02-24 08:32:55Secmark Consultancy Ltd has seen its investment rating downgraded from Sell to Strong Sell as of 23 February 2026, reflecting deteriorating technical indicators and a shift in valuation metrics. Despite a robust long-term growth record, recent quarterly financial results and weakening market signals have prompted a reassessment of the stock’s outlook.

Read full news article

Secmark Consultancy Ltd is Rated Sell

2026-02-20 10:10:49Secmark Consultancy Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 18 February 2026. However, all fundamentals, returns, and financial metrics discussed here reflect the stock's current position as of 20 February 2026, providing investors with the most up-to-date analysis.

Read full news article

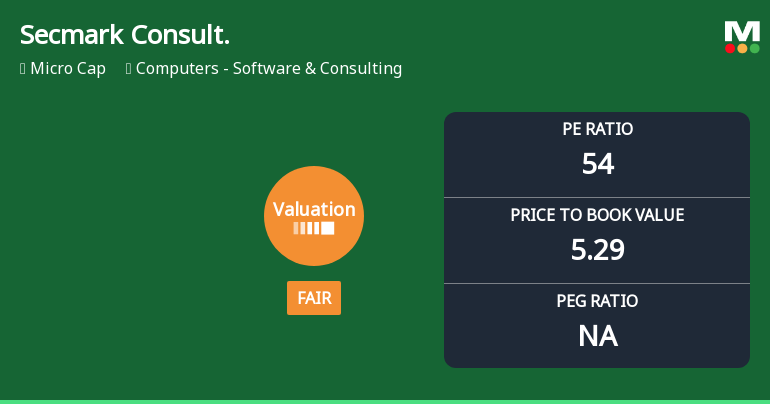

Secmark Consultancy Ltd Valuation Shifts to Fair Amidst Elevated Multiples

2026-02-19 08:02:13Secmark Consultancy Ltd, a player in the Computers - Software & Consulting sector, has seen its valuation grade move from attractive to fair, reflecting a notable shift in price multiples. Despite strong operational returns, the stock’s elevated price-to-earnings and price-to-book ratios suggest a reassessment of its price attractiveness relative to peers and historical benchmarks.

Read full news articleAre Secmark Consultancy Ltd latest results good or bad?

2026-02-14 19:57:03Secmark Consultancy Ltd's latest financial results for Q3 FY26 indicate significant operational challenges. The company reported a net profit of -₹1.88 crores, reflecting a substantial decline from the previous quarter, where it had achieved a profit of ₹0.86 crores. This represents a dramatic shift in profitability, with a reported net profit margin of -25.93%, down from a positive margin of 9.22% in Q2 FY26. Revenue for the quarter fell to ₹7.25 crores, down 22.29% from ₹9.33 crores in Q2 FY26. This decline in sales is notable, especially following a previous quarter that had shown a robust growth of 40.30%. The operating margin also deteriorated sharply, landing at -23.72%, which is the lowest recorded for the company, compared to a positive margin of 21.01% in the prior quarter. The data reveals that employee costs have risen, contributing to the unsustainable operating margins, with employee expenses...

Read full news article

Secmark Consultancy Q3 FY26: Steep Losses Signal Operational Distress

2026-02-14 00:10:03Secmark Consultancy Limited, a micro-cap IT consulting firm with a market capitalisation of ₹115.00 crores, reported a sharp deterioration in its Q3 FY26 performance, posting a net loss of ₹1.88 crores compared to a profit of ₹0.86 crores in Q2 FY26—marking a staggering 318.60% quarter-on-quarter decline. The company's revenue contracted 22.29% sequentially to ₹7.25 crores whilst operating margins collapsed into deeply negative territory at -23.72%, raising serious concerns about the sustainability of its business model.

Read full news articleAre Secmark Consultancy Ltd latest results good or bad?

2026-02-13 20:26:24Secmark Consultancy Ltd's latest financial results for Q2 FY26 indicate a notable recovery from the previous quarter's losses. The company reported a net profit of ₹0.86 crore, a significant turnaround from a loss of ₹0.90 crore in Q1 FY26. This improvement is accompanied by a quarter-on-quarter revenue growth of 40.30%, rising to ₹9.33 crore from ₹6.65 crore in the prior quarter. The operating margin also saw a substantial recovery, reaching 21.01% compared to -5.71% in Q1 FY26. Despite these positive quarterly results, the year-on-year performance reflects challenges, with revenue growth of only 6.14% from ₹8.79 crore in Q2 FY25. The first half of FY26 showed a combined revenue of ₹15.98 crore, marking a 21.92% increase from ₹13.11 crore in H1 FY25, but the net profit for this half-year was a slight loss of ₹0.04 crore, contrasting with a profit of ₹0.37 crore in H1 FY25. The company's financial perform...

Read full news article