Key Events This Week

Jan 19: New 52-week high (Rs.29.8)

Jan 21: All-time high reached (Rs.31.33)

Jan 22: New 52-week and all-time highs (Rs.32.89 / Rs.32.84)

Jan 23: Week closes at Rs.28.80 (-4.03%)

Mar 05

BSE+NSE Vol: 23952

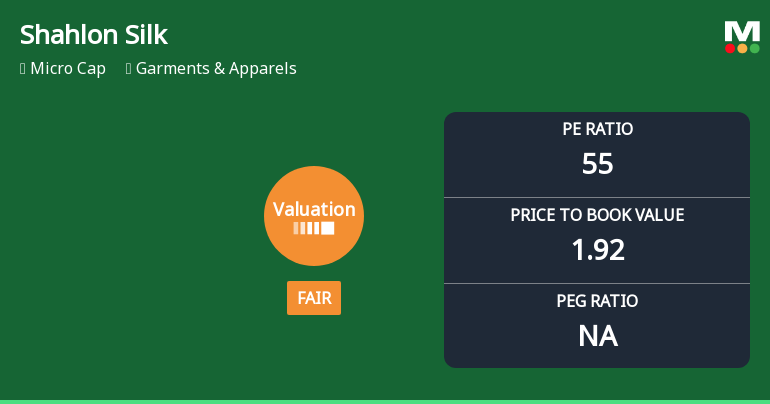

Shahlon Silk Industries Ltd has witnessed a notable shift in its valuation parameters, moving from an attractive to a fair valuation grade. This change reflects evolving market perceptions amid a complex backdrop of financial metrics and peer comparisons within the Garments & Apparels sector. Investors are advised to carefully analyse the implications of these valuation adjustments in the context of the company’s recent performance and broader market trends.

Read full news article

Shahlon Silk Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics discussed here reflect the company’s current position as of 27 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Shahlon Silk Industries Ltd has witnessed a notable change in its valuation parameters, moving from an attractive to a fair valuation grade, reflecting evolving market perceptions amid a volatile price performance. With a current price of ₹23.05 and a price-to-earnings (P/E) ratio of 54.97, investors are reassessing the stock’s price attractiveness relative to its historical averages and peer group in the Garments & Apparels sector.

Read full news article

Shahlon Silk Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics presented here reflect the company’s current position as of 16 February 2026, providing investors with an up-to-date view of its fundamentals, returns, and market standing.

Read full news article

Shahlon Silk Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics discussed here reflect the company’s current position as of 05 February 2026, providing investors with the most up-to-date insights into its performance and outlook.

Read full news article

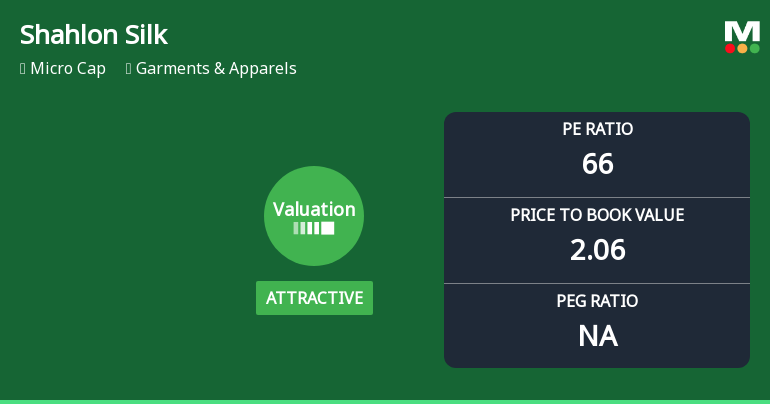

Shahlon Silk Industries Ltd has witnessed a notable shift in its valuation parameters, moving from a fair to an attractive rating, signalling a potential opportunity for investors amid a volatile garments and apparels sector. Despite a recent dip in share price, the company’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios now present a more compelling case relative to its historical averages and peer group, prompting a reassessment of its market standing.

Read full news article

Shahlon Silk Industries Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 13 January 2026. While this rating change occurred on that date, the analysis and financial metrics discussed here reflect the company’s current position as of 25 January 2026, providing investors with an up-to-date view of the stock’s fundamentals, returns, and technical outlook.

Read full news article

Jan 19: New 52-week high (Rs.29.8)

Jan 21: All-time high reached (Rs.31.33)

Jan 22: New 52-week and all-time highs (Rs.32.89 / Rs.32.84)

Jan 23: Week closes at Rs.28.80 (-4.03%)

Shahlon Silk Industries Ltd, a key player in the Garments & Apparels sector, reached a significant milestone today by hitting a new 52-week high of Rs.32.89. This achievement marks a continuation of the stock’s strong upward momentum, reflecting robust market performance over the past year.

Read full news articleShahlon Silk Industries Limited has enclosed herewith extract of newspaper publication relating to unaudited financial results for the quarter and nine months ended December 31 2025.

Shahlon Silk Limited has informed the exchange regarding a press release titled as Advancing Sustainable Development: Shahlon Silk Industries Limited Obtains GPCB Approval for 5 MLD CETP-ZLD and 2 MLD WTP Facility Submits Grant Application and outlines phased Expansion Strategy.

Shahlon Silk Industries Limited has informed that the Board of Directors of the Company at their meeting held on February 14 2026 has appointed M/s. P meet & Co. as an Internal Auditors of the Company. Detailed disclosure is attached herewith.

No Upcoming Board Meetings

Shahlon Silk Industries Ltd has declared 3% dividend, ex-date: 19 Sep 25

Shahlon Silk Industries Ltd has announced 2:10 stock split, ex-date: 11 Nov 21

No Bonus history available

No Rights history available