Recent Price Movement and Market Context

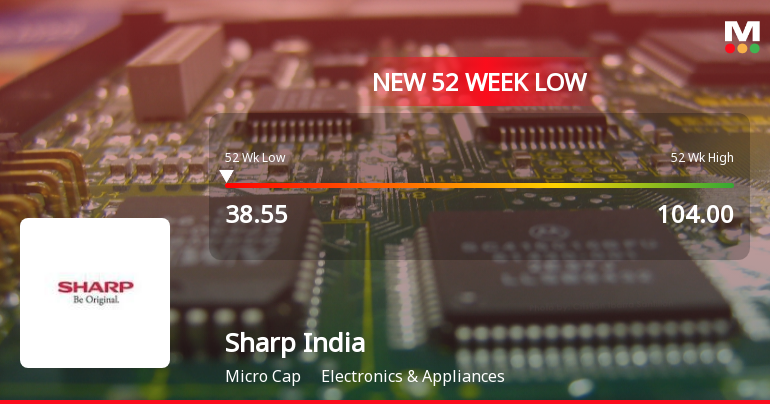

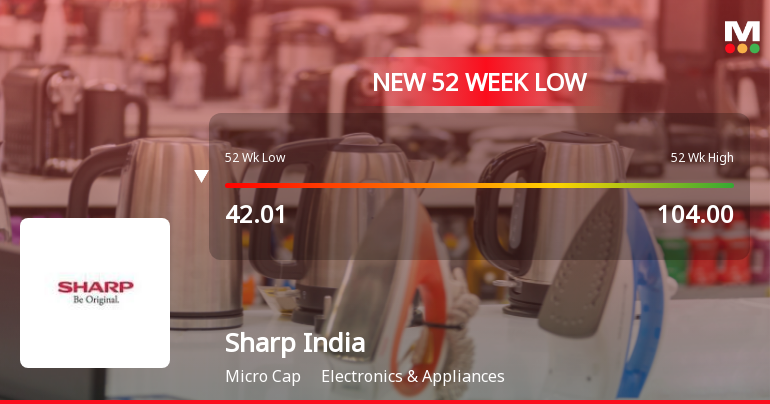

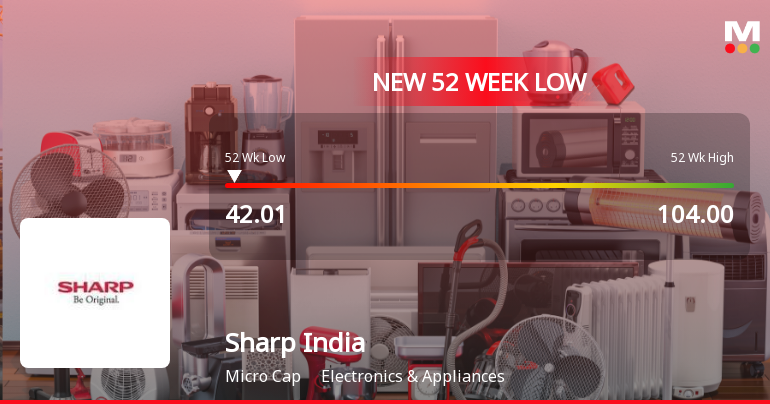

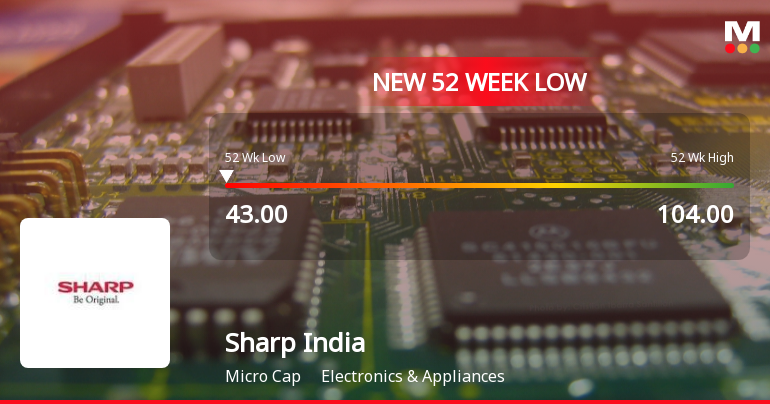

Sharp India’s share price has been under pressure over the past week and month, declining by 6.64% and 13.81% respectively, while the benchmark Sensex advanced by 0.79% and 0.95% over the same periods. This divergence highlights the stock’s relative weakness in a generally positive market environment. The stock’s year-to-date and one-year returns are not available, but its three-year performance shows a steep decline of 31.71%, contrasting sharply with the Sensex’s robust 39.39% gain. Despite this, the stock has delivered a strong five-year return of 127.85%, outperforming the Sensex’s 94.23% over that timeframe.

On 21-Nov, the stock opened with a gap down of nearly 3%, signalling immediate bearish sentiment among investors. Thr...

Read More