Recent Price Movement and Market Context

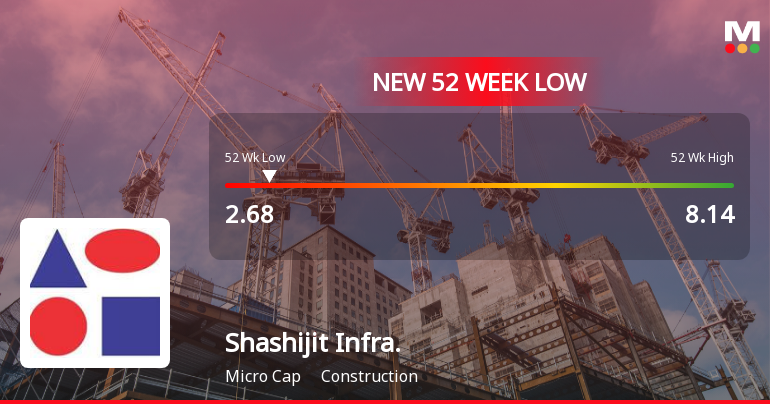

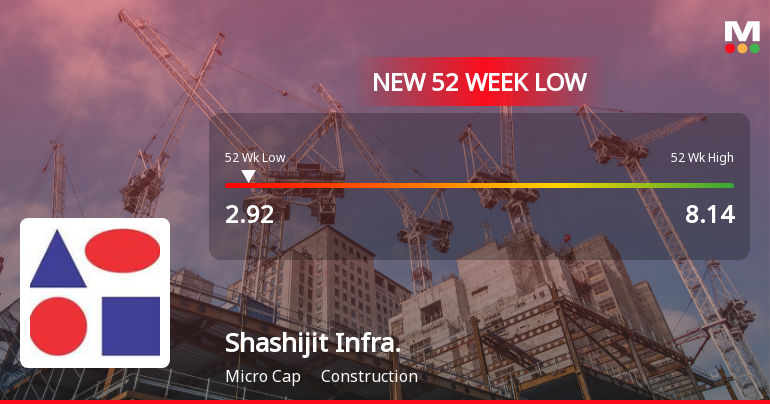

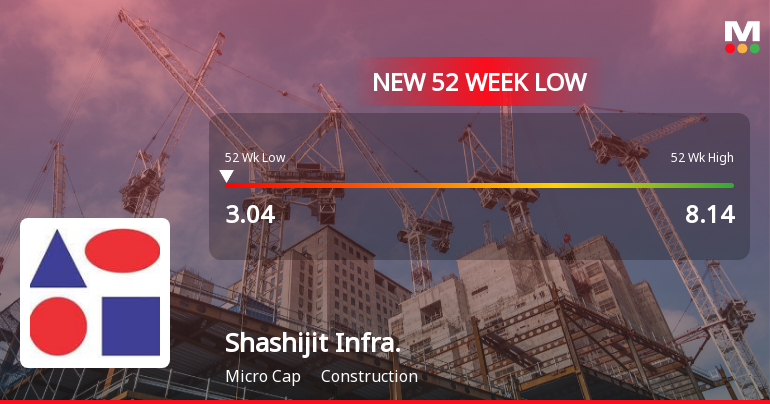

The stock has been on a downward trajectory for the past three consecutive days, losing 13.64% in that period alone. Its performance today notably lagged behind the Construction - Real Estate sector, which itself declined by 2.98%. This underperformance is further emphasised by the stock trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling sustained bearish momentum.

Investor participation appears to be waning, with delivery volumes on 22 Jan dropping by over 63% compared to the five-day average, indicating reduced buying interest. Despite this, liquidity remains sufficient for trading, although the stock’s market activity is subdued relative to its historical norm...

Read full news article