Recent Price Movement and Market Context

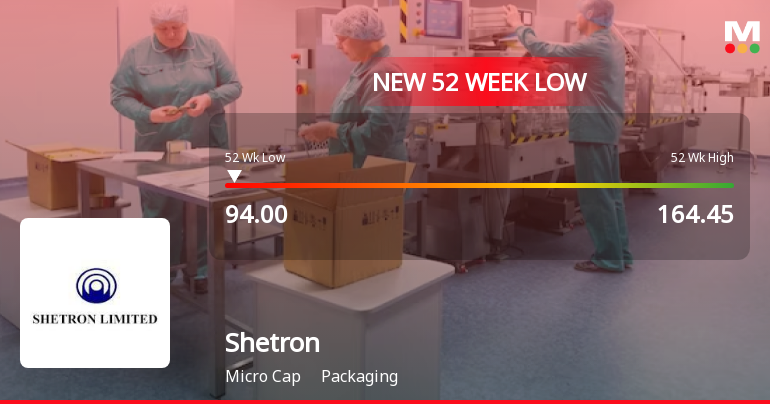

Shetron Ltd’s shares have been under pressure, falling for two consecutive days and registering a cumulative decline of 3.8% over this short period. The stock’s current price is just 4.59% above its 52-week low of ₹104, signalling proximity to a significant support level. This recent weakness contrasts with the broader market, as the Sensex has shown more resilience, despite some volatility.

Over the past week, Shetron’s stock has marginally declined by 0.46%, yet this is still better than the Sensex’s 1.84% drop in the same timeframe. However, the year-to-date (YTD) performance paints a more concerning picture, with Shetron down 15.18%, considerably lagging the Sensex’s 4.62% decline. This underperformance is further accentuate...

Read full news article