Recent Price Performance and Market Comparison

Southern Infoconsultants Ltd has underperformed relative to the benchmark Sensex across multiple timeframes. Over the past week, the stock has declined by 5.58%, significantly steeper than the Sensex’s 1.29% fall. The one-month performance similarly shows a 6.09% drop for the stock against a 3.81% decrease in the Sensex. Year-to-date, the stock is down 4.30%, slightly worse than the Sensex’s 3.42% decline. Over the longer term, the stock’s one-year return stands at -10.57%, contrasting sharply with the Sensex’s positive 7.73% gain. Even over three and five years, Southern Infoconsultants has lagged behind the benchmark, with returns of 31.96% and 29.38% respectively, compared to the Sensex’s 35.77% and 68.39%.

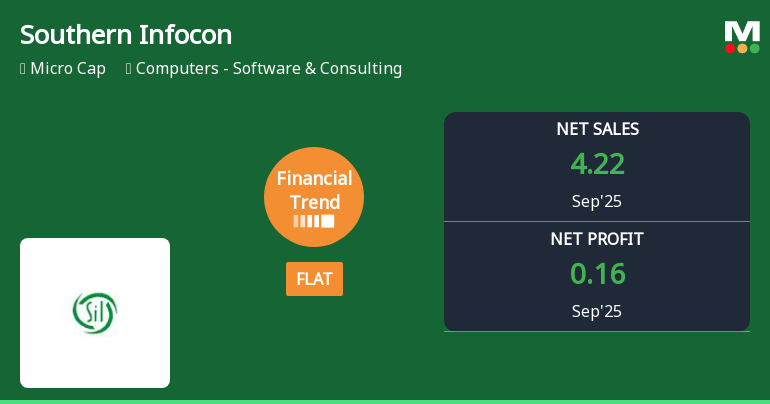

This consist...

Read full news article