Recent Price Performance and Benchmark Comparison

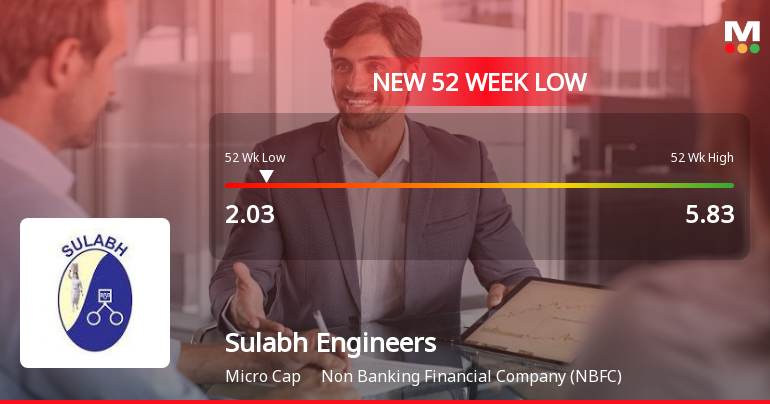

Over the past week, Sulabh Engineers has underperformed marginally compared to the broader Sensex index, registering a decline of 2.54% against the Sensex’s 2.43% fall. While the stock’s one-month performance shows a smaller loss of 1.29%, it contrasts with the Sensex’s sharper 4.66% drop, indicating some relative resilience in the short term. However, year-to-date figures reveal a 5.74% decline for Sulabh Engineers, slightly worse than the Sensex’s 4.32% fall, signalling ongoing pressure on the stock.

More strikingly, the stock’s longer-term performance has been significantly weaker than the benchmark. Over the past year, Sulabh Engineers has plummeted by 54.00%, while the Sensex has gained 6.56%. Similarly, over three...

Read full news article