Recent Price Movement and Market Context

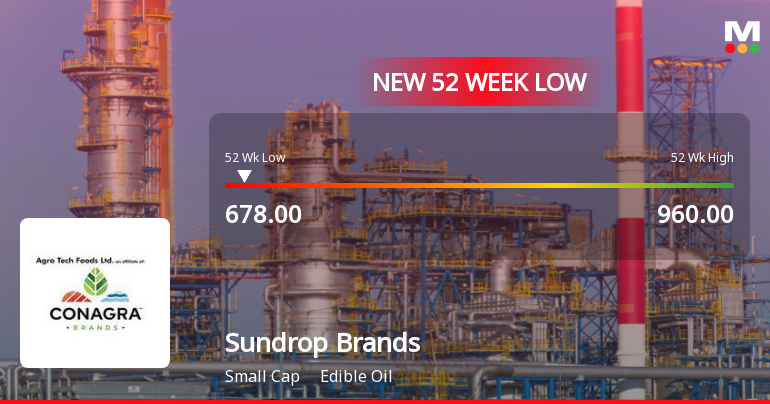

The stock has been under pressure for several sessions, with a consecutive two-day fall resulting in a cumulative loss of 9.16%. Today’s intraday low of ₹616.7 underscores the bearish sentiment prevailing among investors. Notably, the weighted average price indicates that a larger volume of shares traded closer to the day’s low, suggesting selling dominance. Sundrop Brands is currently trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling a sustained downtrend.

The broader sector of Refined Oil and Vanaspati also experienced a decline of 3.53%, indicating that Sundrop’s fall is partly influenced by sector-wide weakness. However, the stock’s underperformance relative...

Read full news article