Key Events This Week

Feb 10: Q3 FY26 results reveal marginal profit recovery amid structural issues

Feb 11: Flat quarterly performance reported with margin gains

Feb 12: Stock dips amid broader market weakness

Feb 13: Strong rebound with 2.25% gain closing the week

Are Sunil Agro Foods Ltd latest results good or bad?

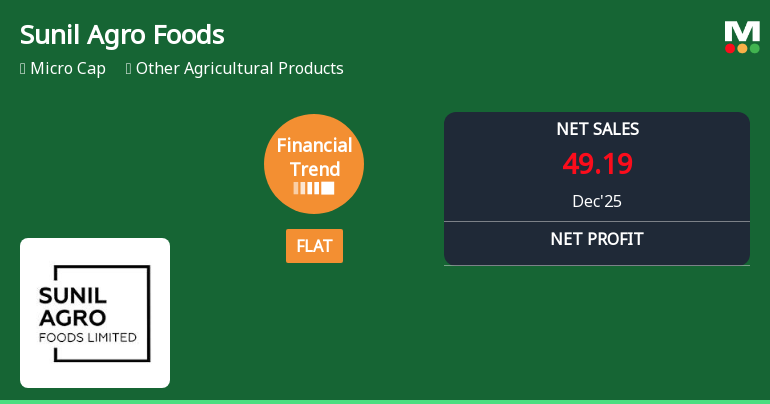

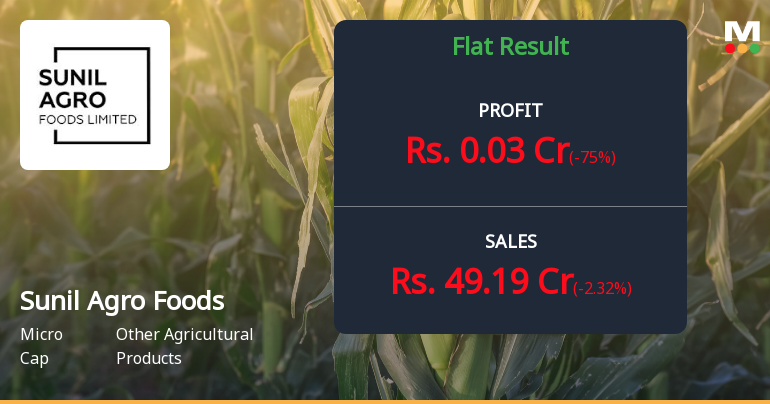

2026-02-11 19:38:30Sunil Agro Foods Ltd's latest financial results for Q3 FY26 indicate a complex operational landscape. The company reported a net profit of ₹0.03 crores, which reflects a significant decline of 75.00% from the previous quarter's profit of ₹0.12 crores. However, this marks a recovery from a loss of ₹0.30 crores in the same quarter last year. Revenue for the quarter was ₹49.19 crores, showing a sequential decline of 2.32% from ₹50.36 crores in Q2 FY26 and a year-on-year contraction of 18.79% from ₹60.57 crores in Q3 FY25. This consistent revenue decline highlights ongoing demand challenges and competitive pressures within the agricultural products sector. Despite these challenges, Sunil Agro Foods achieved its highest operating margin in seven quarters at 2.89%, indicating some improvement in operational efficiency and cost management. However, the profit after tax margin remains extremely thin at 0.06%, down...

Read full news article

Sunil Agro Foods Ltd Reports Flat Quarterly Performance Amid Margin Gains

2026-02-11 08:00:19Sunil Agro Foods Ltd, a player in the Other Agricultural Products sector, has reported a flat financial performance for the quarter ended December 2025, signalling a pause in its previously positive growth trajectory. Despite achieving record operating profit and PAT figures for the quarter, the company’s net sales have declined to their lowest level in recent quarters, prompting a downgrade in its financial trend score and a reassessment of its market outlook.

Read full news article

Sunil Agro Foods Q3 FY26: Marginal Profit Recovery Fails to Mask Persistent Structural Challenges

2026-02-10 18:31:58Sunil Agro Foods Ltd., a micro-cap player in the agricultural products sector with a market capitalisation of ₹28.00 crores, reported a modest return to profitability in Q3 FY26 (October-December 2025), posting a net profit of ₹0.03 crores. However, this marginal recovery—achieved after two consecutive quarters of losses—comes against a backdrop of contracting revenues, deteriorating margins over the past year, and a stock price that has plummeted 25.78% over the last twelve months, significantly underperforming both the benchmark Sensex and its sector peers.

Read full news article