Key Events This Week

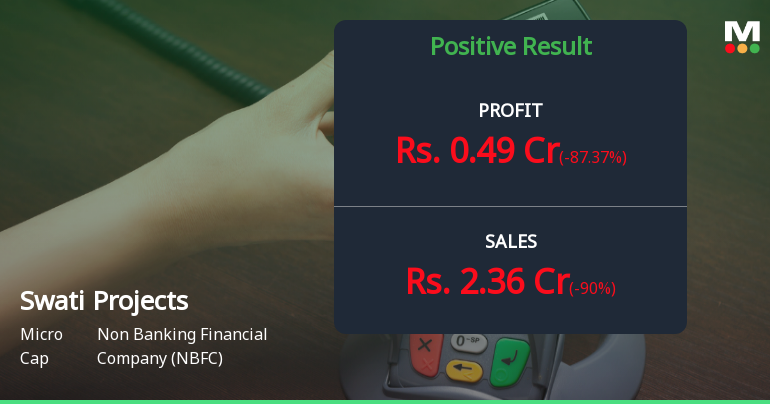

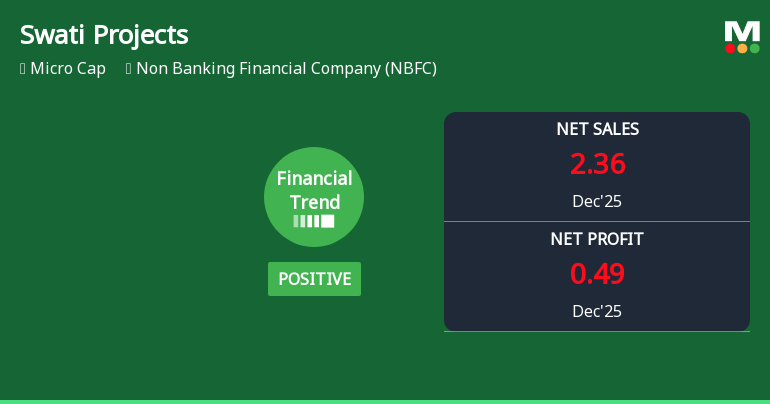

16 Feb: Mixed quarterly results reported, highlighting a 44.6% drop in PAT for the quarter

16 Feb: Stock opens week at Rs.30.25, down 0.95% on the day despite Sensex gains

18 Feb: Modest recovery with a 1.08% gain amid broader market strength

19-20 Feb: Consecutive declines of 2.93% and 1.06% as market volatility intensifies