Key Events This Week

27 Jan: Stock hits 52-week low at Rs.6.79

28 Jan: Sharp recovery post Q2 FY26 results, closing at Rs.7.41 (+9.13%)

29 Jan: Profit-taking leads to 2.83% decline

30 Jan: Modest gain of 0.42%, week closes at Rs.7.23

Are T T Ltd latest results good or bad?

2026-01-29 19:19:43T T Limited's latest financial results for Q2 FY26 indicate a challenging operational environment characterized by significant declines in both net sales and net profit. The company reported net sales of ₹45.67 crores, reflecting a quarter-on-quarter contraction of 5.19% and a year-on-year decrease of 15.91%. This trend of declining sales is concerning, especially as it follows a previous quarter where sales also fell sharply. Net profit for the quarter was recorded at ₹0.18 crores, which represents a substantial decline of 58.14% compared to the prior quarter and a 63.27% drop year-on-year. This sharp reduction in profitability raises questions about the sustainability of the company's earnings, particularly given that a significant portion of the profit was derived from other income, which accounted for more than eight times the net profit figure. The operating margin, excluding other income, decreased ...

Read full news article

T T Ltd Q2 FY26: Marginal Profit Recovery Masks Deeper Revenue Concerns

2026-01-28 20:15:50T T Limited, a Delhi-based garment and apparel manufacturer, reported net profit of ₹0.18 crores in Q2 FY26, representing a sharp 58.14% decline sequentially from ₹0.43 crores in Q1 FY26, whilst posting a year-on-year decline of 63.27% from ₹0.49 crores in Q2 FY25. The micro-cap company, with a market capitalisation of ₹182 crores, saw its stock surge 9.13% following the results announcement, though this appears to be a technical bounce rather than fundamental strength, as the shares remain 56.41% below their 52-week high of ₹17.00.

Read full news article

T T Ltd Stock Falls to 52-Week Low Amidst Continued Downtrend

2026-01-27 09:49:42T T Ltd, a player in the Garments & Apparels sector, touched a new 52-week low of Rs.6.8 today, marking a significant milestone in its ongoing decline. This fresh low reflects the stock’s sustained underperformance relative to the broader market and its sector peers.

Read full news article

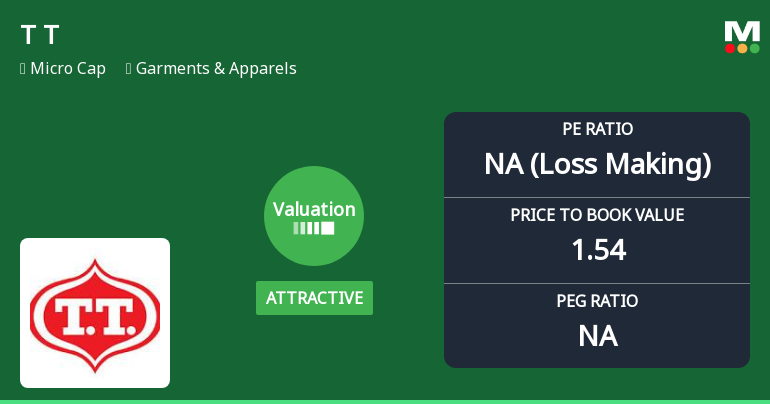

T T Ltd is Rated Strong Sell by MarketsMOJO

2026-01-26 10:10:05T T Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 01 August 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 26 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news articleWhen is the next results date for T T Ltd?

2026-01-22 23:16:07The next results date for T T Ltd is scheduled for 28 January 2026....

Read full news article

T T Ltd is Rated Strong Sell

2026-01-15 10:10:03T T Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 01 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 15 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article