Key Events This Week

23 Feb: Stock opens at Rs.27.53, down 2.48% on weak market sentiment

24 Feb: Valuation shifts amid NBFC sector dynamics; slight recovery to Rs.27.79 (+0.94%)

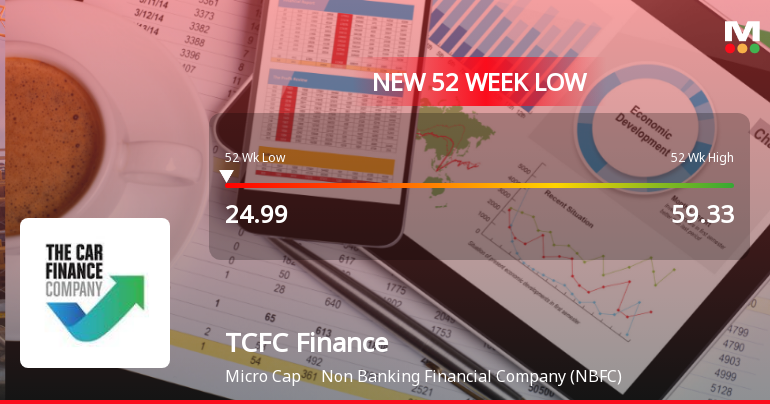

25 Feb: Stock hits 52-week low at Rs.25.96, down 6.59%

26 Feb: Continued decline to Rs.25.51 (-1.73%)

27 Feb: Fresh 52-week low at Rs.25.00, closing the week down 2.00%

TCFC Finance Ltd Falls to 52-Week Low Amid Continued Downtrend

2026-02-27 12:42:37TCFC Finance Ltd, a Non Banking Financial Company (NBFC), touched a new 52-week low of Rs.24.99 today, marking a significant decline in its share price amid a sustained negative trend. The stock has underperformed its sector and broader market indices, reflecting ongoing concerns about its financial performance and valuation metrics.

Read full news article

TCFC Finance Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

2026-02-25 14:37:33TCFC Finance Ltd, a Non Banking Financial Company (NBFC), touched a new 52-week low of Rs.25.52 today, marking a significant decline in its stock price amid ongoing underperformance relative to its sector and broader market indices.

Read full news article

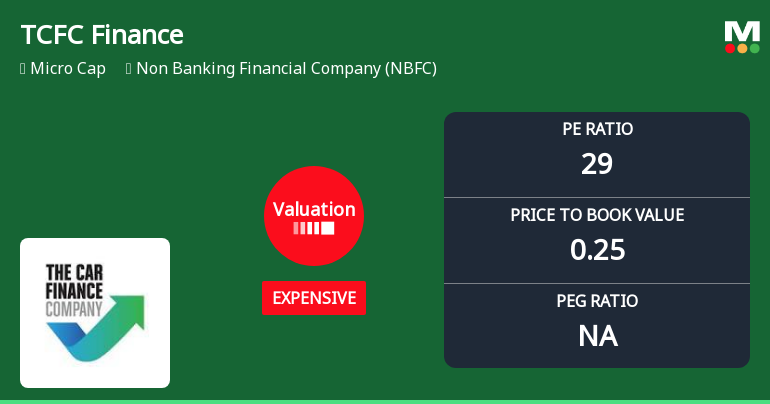

TCFC Finance Ltd Valuation Shifts Amid NBFC Sector Dynamics

2026-02-24 08:02:43TCFC Finance Ltd, a player in the Non Banking Financial Company (NBFC) sector, has seen its valuation parameters shift notably, moving from a 'very expensive' to an 'expensive' rating. Despite this marginal improvement, the company’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios remain elevated compared to sector peers, raising questions about its price attractiveness and investment appeal amid subdued returns and weak profitability metrics.

Read full news articleTCFC Finance Ltd Falls 3.82%: Downgrades and Valuation Risks Weigh on Stock

2026-02-21 13:04:04

Key Events This Week

16 Feb: Q3 FY26 results reveal mounting losses and trading volatility

17 Feb: Downgrade to Below Average Quality and Strong Sell rating announced

17 Feb: Valuation metrics signal elevated price risk amid sector challenges

20 Feb: Stock closes the week at Rs.28.23, down 3.82%

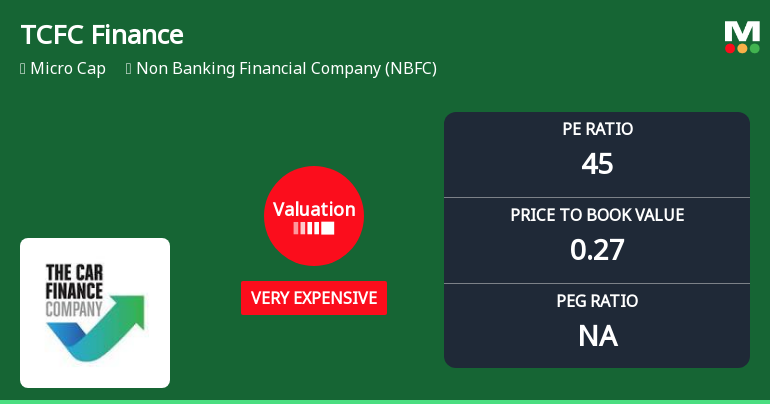

TCFC Finance Ltd Downgraded to Strong Sell Amid Weak Fundamentals and Expensive Valuation

2026-02-17 08:49:27TCFC Finance Ltd, a Non Banking Financial Company (NBFC), has been assigned a Strong Sell rating with a Mojo Score of 16.0, reflecting a significant downgrade from its previous ungraded status. This change, effective from 16 Feb 2026, is driven by deteriorating quality metrics, an expensive valuation profile, a flat financial trend, and weak technical signals, signalling caution for investors amid challenging market conditions.

Read full news article

TCFC Finance Ltd Valuation Shifts Signal Elevated Price Risk Amid Sector Challenges

2026-02-17 08:03:48TCFC Finance Ltd, a Non-Banking Financial Company (NBFC), has seen a marked shift in its valuation parameters, moving from a risky to a very expensive rating. Despite this, the company’s share price has declined over multiple time horizons, underperforming the broader Sensex index. This article analyses the recent valuation changes, compares TCFC Finance’s metrics with its peers, and examines the implications for investors amid subdued profitability and weak returns.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2026 | Source : BSENewspaper Advertisement for UFR for quarter and Nine Months ended 31st December 2025

Board Meeting Outcome for Outcome Of Board Meeting Held On 13Th February 2026

13-Feb-2026 | Source : BSEOutcome of Board Meeting held on 13th February 2026 to consider and approve Unaudited Standalone Financial Results of the Company for the quarter and nine months ended 31st December 2025

Financial Results For Quarter And Nine Months Ended 31 December 2025

13-Feb-2026 | Source : BSEFinancial Results for Quarter and Nine Months Ended 31st December 2025

Corporate Actions

No Upcoming Board Meetings

TCFC Finance Ltd has declared 18% dividend, ex-date: 23 Jul 24

No Splits history available

No Bonus history available

No Rights history available