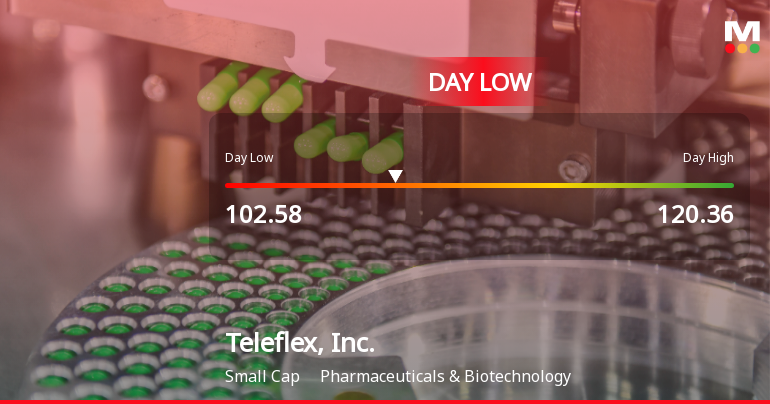

Teleflex Stock Hits Day Low of $102.58 Amid Price Pressure

2025-11-07 16:33:29Teleflex, Inc. has faced notable volatility, with a significant stock decline today. Over the past year, the company has underperformed compared to the S&P 500. Despite a low debt-to-equity ratio and strong interest coverage, long-term growth appears limited, with modest increases in net sales and operating profit.

Read full news article

Teleflex, Inc. Stock Plummets to New 52-Week Low of $102.58

2025-11-07 15:56:56Teleflex, Inc. has reached a new 52-week low, reflecting a significant decline in its stock performance over the past year compared to the S&P 500. The company, with a market cap of approximately USD 5,892 million, faces challenges in long-term growth despite some positive financial metrics.

Read full news articleIs Teleflex, Inc. technically bullish or bearish?

2025-11-05 11:17:41As of 31 October 2025, the technical trend for Teleflex, Inc. has changed from sideways to mildly bearish. The weekly MACD indicates a mildly bullish stance, while the monthly MACD is bearish. The RSI shows no signal on the weekly chart but is bullish on the monthly. Moving averages are bearish on the daily timeframe. The KST is bullish weekly but bearish monthly, and Dow Theory suggests a mildly bearish outlook on the weekly chart with no trend monthly. In terms of performance, Teleflex has underperformed significantly compared to the S&P 500 across multiple periods, with a year-to-date return of -30.10% versus the S&P 500's 16.30%, and a one-year return of -41.10% compared to 19.89% for the index. Overall, the current technical stance is mildly bearish, driven by the bearish moving averages and mixed signals from MACD and KST....

Read full news articleIs Teleflex, Inc. technically bullish or bearish?

2025-11-04 11:28:55As of 31 October 2025, the technical trend for Teleflex, Inc. has changed from sideways to mildly bearish. The current technical stance is bearish overall, with key indicators showing mixed signals across different time frames. The weekly MACD is mildly bullish, while the monthly MACD is bearish. The RSI shows a bullish signal on the monthly but no signal on the weekly. Moving averages indicate a bearish stance on the daily. Despite some bullish signals in the weekly KST and Dow Theory, the overall sentiment is bearish due to the monthly indicators. In terms of performance, Teleflex has significantly underperformed the S&P 500 across all multi-period returns, with a year-to-date decline of 30.98% compared to the S&P 500's gain of 16.30%....

Read full news article

Teleflex, Inc. Experiences Valuation Adjustment Amidst Market Challenges and Competitive Landscape

2025-11-03 15:57:25Teleflex, Inc. has recently adjusted its valuation, with its current price at $124.47. Over the past year, the company has faced challenges, posting a return of -38.09%. Key financial metrics include a P/E ratio of 13 and a dividend yield of 1.15%, indicating competitive positioning but room for improvement.

Read full news articleIs Teleflex, Inc. technically bullish or bearish?

2025-11-03 11:27:42As of 31 October 2025, the technical trend for Teleflex, Inc. has changed from sideways to mildly bearish. The current stance is bearish, with key indicators such as the daily moving averages signaling bearishness and the monthly MACD showing a bearish trend. Although the weekly MACD and KST are mildly bullish, the overall momentum is dampened by the bearish monthly signals. Additionally, the stock has significantly underperformed the S&P 500 across multiple periods, with a year-to-date return of -30.07% compared to the S&P 500's 16.30%, and a one-year return of -38.09% versus 19.89% for the index....

Read full news articleIs Teleflex, Inc. technically bullish or bearish?

2025-11-02 11:14:27As of 31 October 2025, the technical trend for Teleflex, Inc. has changed from sideways to mildly bearish. The current stance is bearish, driven primarily by the daily moving averages indicating a bearish signal. While the weekly MACD and KST are mildly bullish, the monthly MACD and KST are bearish, suggesting mixed signals across time frames. The RSI shows a bullish signal on the monthly but no signal on the weekly, adding to the uncertainty. Additionally, the stock has significantly underperformed the S&P 500 across multiple periods, with a year-to-date return of -30.07% compared to the S&P 500's 16.30%, and a one-year return of -38.09% versus 19.89% for the index....

Read full news article

Teleflex, Inc. Experiences Revision in Stock Evaluation Amid Competitive Market Landscape

2025-10-27 15:59:02Teleflex, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 13 and a price-to-book value of 1.36. The company’s financial metrics, including a PEG ratio of 0.39 and a dividend yield of 1.15%, highlight its positioning amid varied competitor valuations in the Pharmaceuticals & Biotechnology sector.

Read full news article

Teleflex, Inc. Experiences Evaluation Revision Amidst Mixed Market Performance Indicators

2025-10-27 15:44:50Teleflex, Inc. has recently revised its evaluation amid fluctuating stock performance, closing at $132.35. The company has faced significant challenges over the past year, with a notable decline compared to the S&P 500. Mixed technical indicators suggest varied momentum as it navigates current market dynamics.

Read full news article