Is The Bancorp, Inc. (Delaware) overvalued or undervalued?

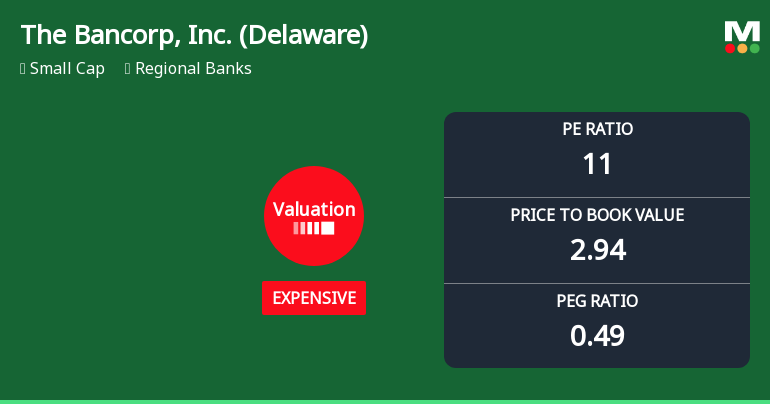

2025-11-05 11:11:02As of 31 October 2025, The Bancorp, Inc. (Delaware) moved from very expensive to expensive, indicating a shift in its valuation perception. The company is currently considered overvalued based on its valuation metrics. Key ratios include a P/E ratio of 11, a Price to Book Value of 2.94, and an EV to EBITDA of 4.42. In comparison to peers, Atlantic Union Bankshares Corp. has a higher P/E of 17.24, while Independent Bank Corp. (Massachusetts) shows a fair valuation with a P/E of 18.40. Despite the recent overvaluation, The Bancorp has demonstrated strong performance with a 5-year return of 559.28%, significantly outpacing the S&P 500's 109.18% during the same period. However, the recent one-week and one-month returns of -21.10% and -18.35%, respectively, highlight potential volatility and investor concerns....

Read full news articleIs The Bancorp, Inc. (Delaware) overvalued or undervalued?

2025-11-04 11:17:00As of 31 October 2025, the valuation grade for The Bancorp, Inc. (Delaware) moved from very expensive to expensive. The company appears to be overvalued based on its current metrics. Key ratios include a P/E ratio of 11, a Price to Book Value of 2.94, and an EV to EBITDA of 4.42, which suggest that the stock is trading at a premium compared to its earnings and book value. In comparison to peers, The Bancorp's P/E ratio of 11 is significantly lower than Atlantic Union Bankshares Corp. at 17.24 and Independent Bank Corp. (Massachusetts) at 18.40, indicating a relative undervaluation against these competitors. Despite recent stock performance showing a 26.75% return over the past year compared to the S&P 500's 19.89%, the overall valuation metrics suggest that the stock is not justified at its current price levels....

Read full news article

The Bancorp, Inc. Hits Day Low of $64.52 Amid Price Pressure

2025-11-03 17:41:33The Bancorp, Inc. faced a notable decline in stock value today, contrasting with the S&P 500's modest gain. Despite recent short-term losses, the company has shown strong long-term performance, with significant annual growth and solid financial metrics, including a robust net interest margin and capital adequacy ratio.

Read full news article

The Bancorp, Inc. Experiences Revision in Its Stock Evaluation Amid Strong Performance Metrics

2025-11-03 15:29:53The Bancorp, Inc. has recently adjusted its valuation, with a P/E ratio of 11 and a price-to-book value of 2.94. The company has demonstrated strong performance, achieving a year-to-date return of 24.21% and a five-year return of 580.94%, positioning itself competitively within the regional banking sector.

Read full news articleIs The Bancorp, Inc. (Delaware) overvalued or undervalued?

2025-11-03 11:16:27As of 31 October 2025, the valuation grade for The Bancorp, Inc. (Delaware) moved from very expensive to expensive. The company appears to be overvalued based on its current valuation metrics. The P/E ratio stands at 11, which is significantly lower than the peer average of 15.42 for similar companies, while the Price to Book Value is 2.94, indicating a premium over book value. Additionally, the PEG ratio of 0.49 suggests that the stock may be undervalued relative to its earnings growth potential, yet the overall context points to overvaluation. In comparison to its peers, Atlantic Union Bankshares Corp. has a P/E of 17.24, and Independent Bank Corp. (Massachusetts) has a P/E of 18.40, both indicating a higher valuation relative to The Bancorp. Despite a strong YTD return of 24.21% compared to the S&P 500's 16.30%, the recent one-week and one-month returns of -16.98% and -11.33% respectively highlight a co...

Read full news articleIs The Bancorp, Inc. (Delaware) overvalued or undervalued?

2025-11-02 11:09:29As of 31 October 2025, the valuation grade for The Bancorp, Inc. (Delaware) moved from very expensive to expensive, indicating a slight improvement in its valuation outlook. The company appears to be overvalued based on its current metrics. Key ratios include a P/E ratio of 11, a Price to Book Value of 2.94, and an EV to EBITDA of 4.42. In comparison, peers such as Atlantic Union Bankshares Corp. have a P/E of 17.24, while Independent Bank Corp. (Massachusetts) has a P/E of 18.40, highlighting that The Bancorp is trading at a significant discount relative to its peers. Despite the overvaluation, The Bancorp has shown strong performance with a year-to-date return of 24.21%, outperforming the S&P 500's return of 16.30% in the same period. However, the recent one-week and one-month returns of -16.98% and -11.33%, respectively, suggest volatility that may be concerning for investors....

Read full news article