Key Events This Week

Feb 9: Stock opens strong at Rs.1,776.70 (+2.24%) amid positive market sentiment

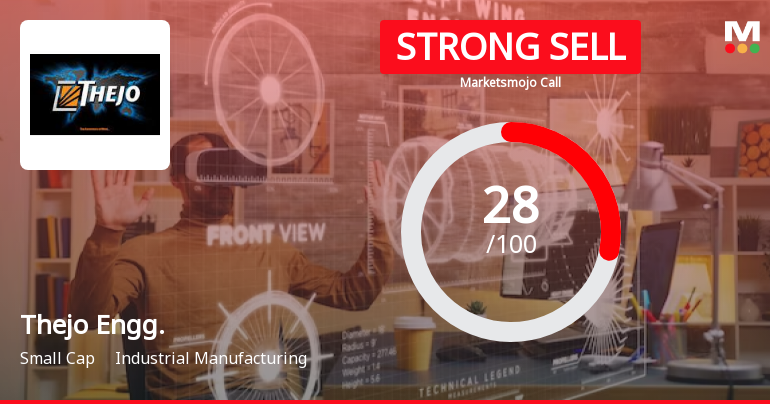

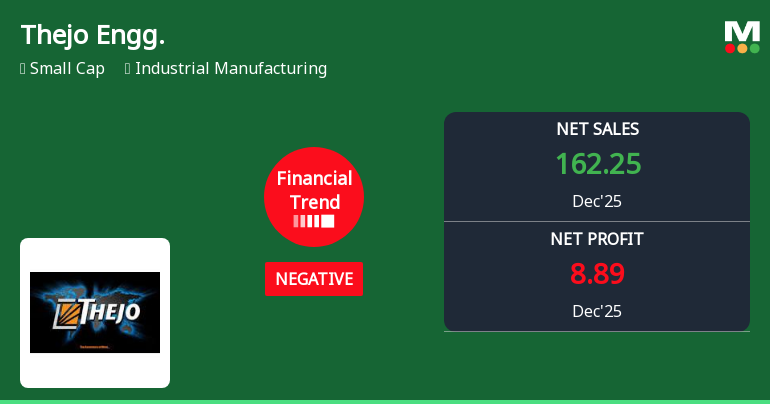

Feb 10: Negative financial trend reported; stock declines 1.68% to Rs.1,746.90

Feb 12: Continued margin compression leads to 3.26% drop to Rs.1,665.60

Feb 13: Valuation shifts signal changing market sentiment; stock rebounds 2.56% to Rs.1,708.30