Key Events This Week

19 Jan: New 52-week low at Rs.676.65

20 Jan: Further 52-week low at Rs.667.25

21 Jan: Fresh 52-week low at Rs.653.85 amid market downturn

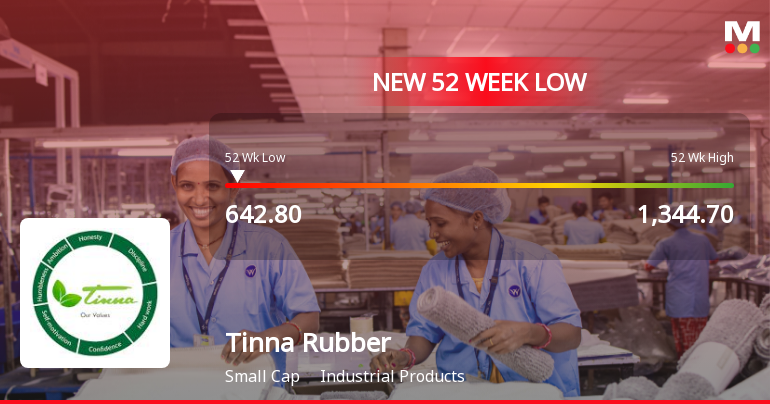

22 Jan: Lowest 52-week low at Rs.642.8 with slight intraday recovery

23 Jan: Strong gap up opening, closing at Rs.662.25 (+0.55%)

Tinna Rubber & Infrastructure Ltd Opens with Strong Gap Up, Reflecting Positive Market Sentiment

2026-01-23 13:20:28Tinna Rubber & Infrastructure Ltd witnessed a significant gap up at the market open today, surging 20.0% from its previous close, signalling a robust start and positive sentiment in the industrial products sector. This sharp opening move was accompanied by heightened volatility and outperformance relative to its sector peers.

Read full news article

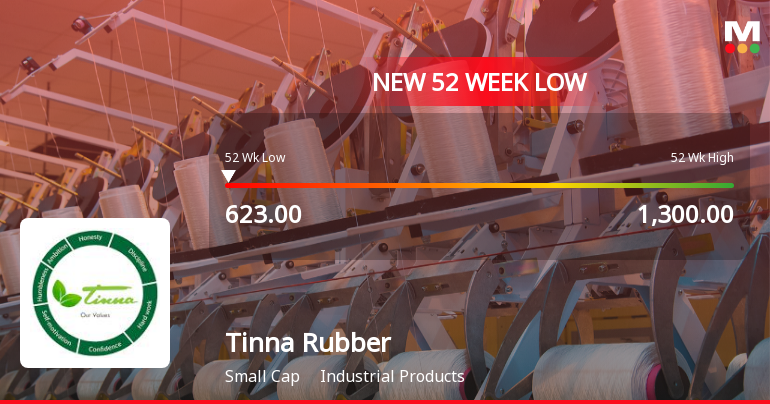

Tinna Rubber & Infrastructure Ltd Falls to 52-Week Low of Rs.642.8

2026-01-22 10:42:05Tinna Rubber & Infrastructure Ltd’s stock touched a fresh 52-week low of Rs.642.8 today, marking a significant decline amid broader market fluctuations. The stock’s performance over the past year has been notably weaker than the benchmark Sensex, reflecting a challenging period for the industrial products company.

Read full news article

Tinna Rubber & Infrastructure Ltd is Rated Sell

2026-01-22 10:10:04Tinna Rubber & Infrastructure Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 01 Jan 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 22 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

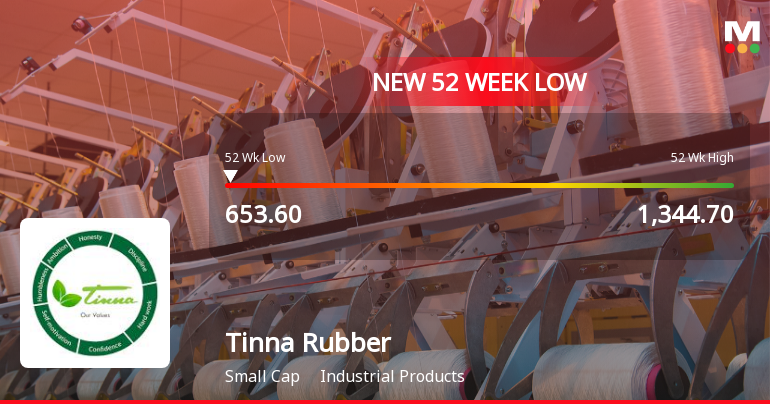

Tinna Rubber & Infrastructure Ltd Falls to 52-Week Low Amid Market Downturn

2026-01-21 11:10:48Tinna Rubber & Infrastructure Ltd has declined to a fresh 52-week low of Rs.653.85 on 21 Jan 2026, marking a significant downturn amid a broader market weakness and sectoral pressures. The stock has now recorded a nine-day consecutive fall, accumulating a loss of 13.11% over this period.

Read full news article

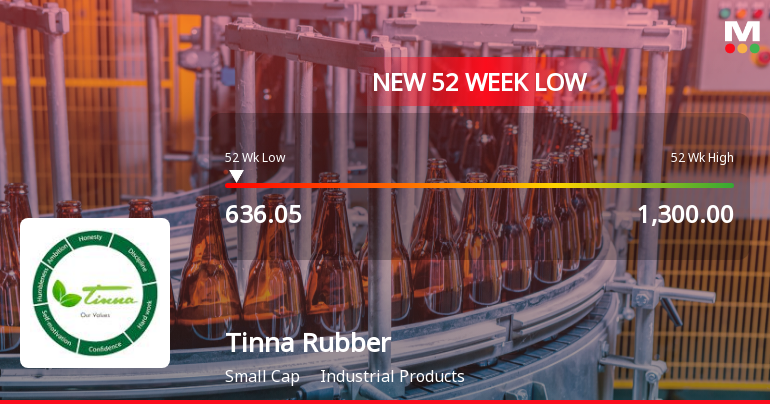

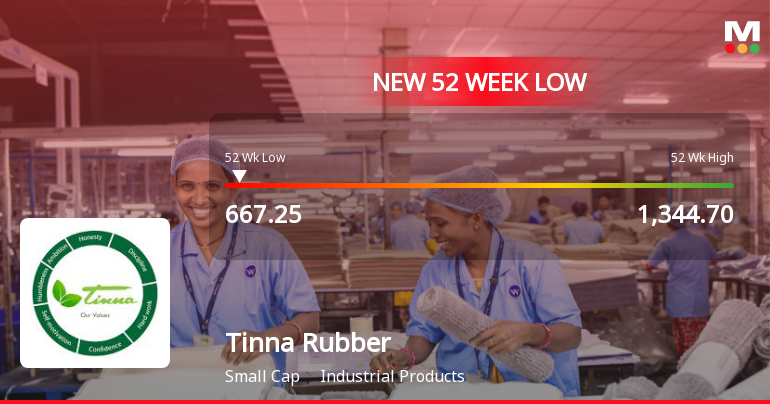

Tinna Rubber & Infrastructure Ltd Falls to 52-Week Low of Rs.667.25

2026-01-20 10:24:43Tinna Rubber & Infrastructure Ltd’s stock declined to a fresh 52-week low of Rs.667.25 on 20 Jan 2026, marking a significant downturn amid a broader market environment that has seen the Sensex retreat over recent weeks. The stock has been on a downward trajectory for eight consecutive trading sessions, shedding 11.35% in that period.

Read full news article

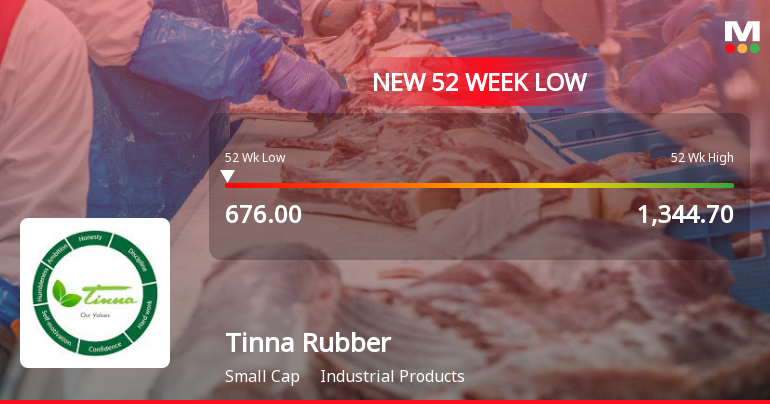

Tinna Rubber & Infrastructure Ltd Falls to 52-Week Low of Rs.676.65

2026-01-19 09:46:51Tinna Rubber & Infrastructure Ltd has touched a new 52-week low of Rs.676.65 today, marking a significant decline amid a broader market downturn. The stock has been on a downward trajectory for the past seven consecutive sessions, registering a cumulative loss of 9.96% during this period.

Read full news article