Key Events This Week

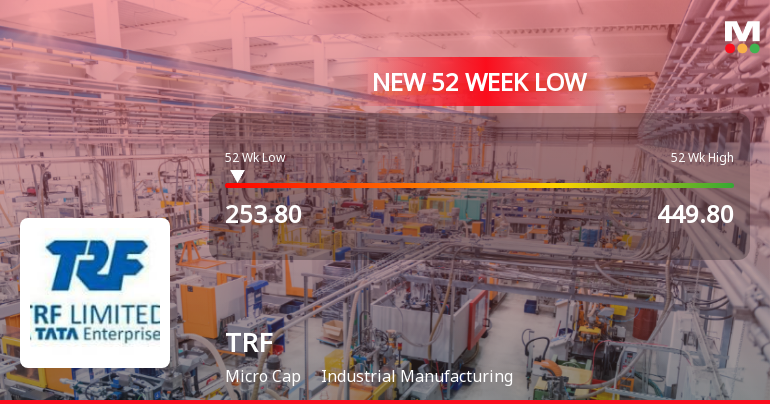

Jan 27: Stock hits 52-week low at Rs.252.8

Jan 28: Sharp rebound with 6.89% gain to Rs.274.70

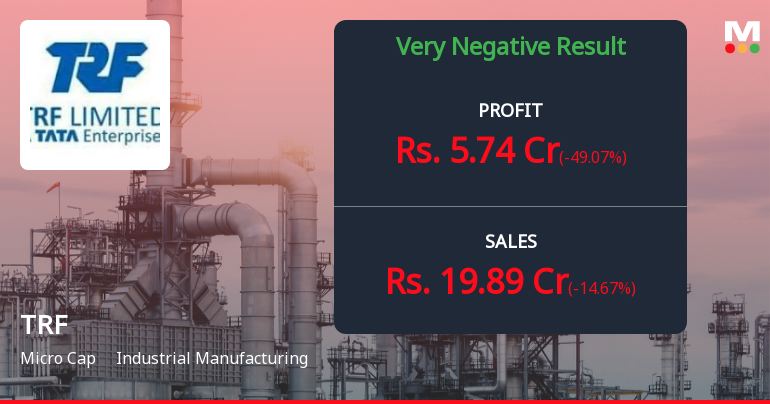

Jan 29: Quarterly results reveal mounting losses

Jan 30: Strong rally closes week at Rs.291.00 (+6.87%)

Are TRF Ltd latest results good or bad?

2026-01-30 19:25:38TRF Ltd's latest financial results indicate a challenging operational environment. For the quarter ending September 2025, the company reported a net loss of ₹6.81 crores, marking a significant decline compared to the previous quarter's profit of ₹3.51 crores. This shift to losses raises concerns about the sustainability of its business model, especially as net sales fell to ₹22.34 crores, reflecting a year-on-year contraction of 31.68% and a sequential decline of 4.61%. Despite a modest improvement in operating margins, which rose to 22.74% from 13.66% in the prior quarter, this was insufficient to counterbalance the adverse effects of declining revenues and rising interest costs. The interest expenses increased sharply to ₹4.16 crores, consuming 18.62% of net sales, highlighting ongoing financial strain. The company's operational challenges appear to be structural, with a five-year sales growth rate of -...

Read full news article

TRF Ltd Q2 FY26: Losses Mount as Revenue Decline Accelerates

2026-01-29 21:02:46TRF Ltd, the Tata Group-affiliated material handling equipment manufacturer, reported a net loss of ₹6.81 crores for Q2 FY26, marking a dramatic reversal from the ₹3.51 crores profit posted in the previous quarter. The micro-cap company, with a market capitalisation of ₹301.00 crores, saw its stock decline 1.71% following the results announcement, closing at ₹270.00 on January 29, 2026. The quarterly performance reflects deepening operational challenges as revenue contraction continues unabated.

Read full news article

TRF Ltd Stock Hits 52-Week Low Amid Continued Downtrend

2026-01-27 11:30:41TRF Ltd, a key player in the Industrial Manufacturing sector, has touched a new 52-week low of Rs.252.8 today, marking a significant decline in its stock price amid ongoing underperformance and subdued financial results.

Read full news article

TRF Ltd is Rated Strong Sell

2026-01-25 10:10:30TRF Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 16 June 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 25 January 2026, providing investors with an up-to-date view of the stock’s performance and outlook.

Read full news articleWhen is the next results date for TRF Ltd?

2026-01-22 23:16:28The next results date for TRF Ltd is scheduled for 29 January 2026....

Read full news article

TRF Ltd Stock Falls to 52-Week Low of Rs.253.8 Amid Continued Downtrend

2026-01-21 12:16:18TRF Ltd, a key player in the Industrial Manufacturing sector, has touched a new 52-week low of Rs.253.8 today, marking a significant decline in its stock price amid a sustained downward trend over recent sessions.

Read full news article

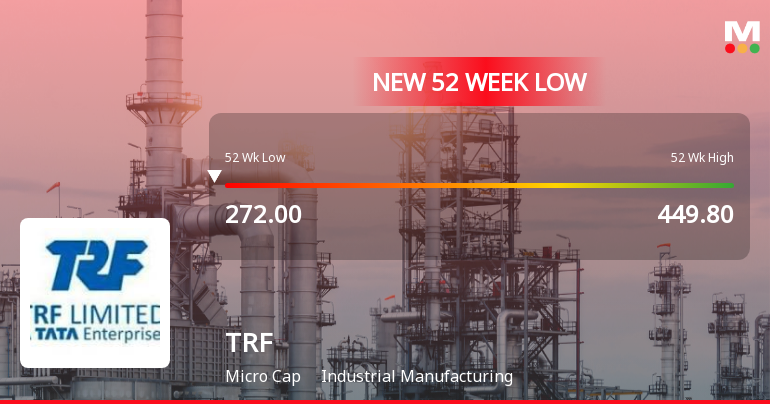

TRF Ltd Stock Falls to 52-Week Low of Rs.271 Amid Continued Downtrend

2026-01-20 12:44:11TRF Ltd, a key player in the Industrial Manufacturing sector, has touched a fresh 52-week low of Rs.271 today, marking a significant decline amid ongoing downward momentum. The stock’s performance continues to lag behind sector peers and broader market indices, reflecting persistent challenges in its financial trajectory.

Read full news article