Trupanion Stock Hits Day Low of $38.13 Amid Price Pressure

2025-11-10 17:50:50Trupanion, Inc. faced a notable decline in its stock price today, reflecting broader challenges in the market. Despite recent fluctuations, the company has shown strong long-term fundamentals, including a significant compound annual growth rate in operating profits and consistent positive results over the last five quarters.

Read full news article

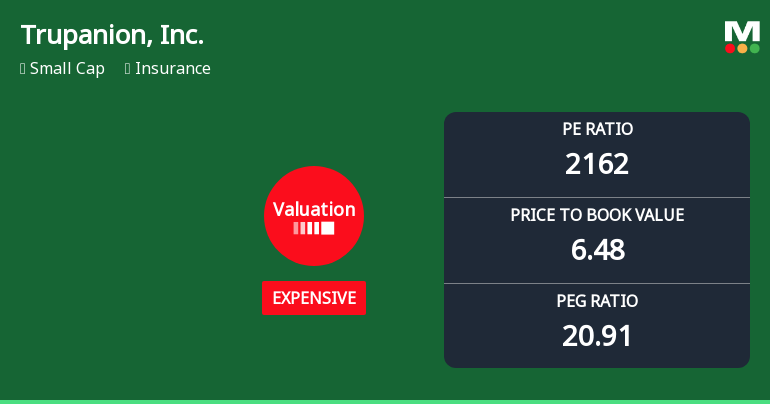

Trupanion, Inc. Experiences Revision in Its Stock Evaluation Amid Competitive Landscape

2025-11-10 16:10:23Trupanion, Inc. has recently adjusted its valuation, revealing high financial metrics such as a P/E ratio of 2162 and a PEG ratio of 20.91. Compared to peers like AXIS Capital and MGIC Investment, Trupanion's stock has struggled, showing a year-to-date return significantly lower than the S&P 500.

Read full news article

Trupanion Stock Soars 7.16%, Hits Intraday High of $42.52

2025-11-06 16:16:46Trupanion, Inc. has shown significant performance today, contrasting with broader market trends. Despite a challenging year, the company boasts strong long-term fundamentals, including impressive growth rates in operating profits and net sales. Its operational strength is reflected in consistent positive results and full institutional ownership, indicating robust investor confidence.

Read full news articleIs Trupanion, Inc. technically bullish or bearish?

2025-11-05 11:23:13As of 31 October 2025, the technical trend for Trupanion, Inc. has changed from mildly bearish to bearish. The current stance is bearish with a weak strength indicated by the weekly MACD and Bollinger Bands both showing bearish signals, while the monthly MACD is only mildly bullish. The RSI is bearish on a monthly basis, and moving averages are bearish on a daily basis. Additionally, the KST and Dow Theory are both bearish on a weekly basis. Trupanion's performance has significantly lagged behind the S&P 500, with a year-to-date return of -18.28% compared to the S&P 500's 16.30%, and a one-year return of -27.80% versus 19.89% for the index....

Read full news articleIs Trupanion, Inc. technically bullish or bearish?

2025-11-04 11:35:08As of 31 October 2025, the technical trend for Trupanion, Inc. has changed from mildly bearish to bearish. The current stance is bearish with weak strength indicated by the weekly MACD and Bollinger Bands both showing bearish signals. Daily moving averages also confirm a bearish outlook. The KST is bearish on a weekly basis and mildly bearish monthly, while Dow Theory reflects a mildly bearish stance across both time frames. The OBV shows mild bullishness weekly but is mildly bearish monthly, indicating mixed signals. In terms of performance, Trupanion has underperformed the S&P 500 across multiple periods, with a year-to-date return of -17.74% compared to the S&P 500's 16.30%, and a one-year return of -27.33% against the S&P 500's 19.89%....

Read full news articleIs Trupanion, Inc. technically bullish or bearish?

2025-11-03 11:34:40As of 31 October 2025, the technical trend for Trupanion, Inc. has changed from mildly bearish to bearish. The current technical stance is bearish with a weak strength. Key indicators driving this stance include a bearish MACD on the weekly timeframe, bearish Bollinger Bands on both weekly and monthly timeframes, and bearish moving averages on the daily timeframe. Additionally, the KST is bearish on the weekly and mildly bearish on the monthly. The stock has underperformed significantly against the S&P 500, with a year-to-date return of -17.03% compared to the S&P 500's 16.30%....

Read full news article