Key Events This Week

27 Jan: Stock opens strong at ₹316.50, up 1.87%

28 Jan: Q2 FY26 results reveal margin pressures

30 Jan: Quality grade downgraded to good; technical signals mixed

30 Jan: Week closes at ₹351.20, up 4.84% on the day

V-Guard Industries Ltd Sees Mixed Technical Signals Amid Price Momentum Shift

2026-01-30 08:00:38V-Guard Industries Ltd has experienced a notable shift in price momentum, reflected in a complex array of technical indicators that suggest a cautious outlook for investors. While the stock posted a robust 4.48% gain on 30 Jan 2026, underlying technical signals reveal a transition from bearish to mildly bearish trends, prompting a downgrade in its Mojo Grade from Hold to Sell.

Read full news article

V-Guard Industries Ltd Quality Grade Downgrade: A Detailed Analysis of Business Fundamentals

2026-01-30 08:00:07V-Guard Industries Ltd, a key player in the Electronics & Appliances sector, has recently seen its quality grade downgraded from excellent to good by MarketsMOJO, reflecting subtle shifts in its business fundamentals. This article delves into the factors behind this change, analysing key financial metrics such as return on equity (ROE), return on capital employed (ROCE), debt levels, and growth consistency to provide investors with a comprehensive understanding of the company’s evolving profile.

Read full news articleWhy is V-Guard Industries Ltd falling/rising?

2026-01-30 00:50:04

Recent Price Movement and Market Context

V-Guard Industries has demonstrated strong short-term gains, outperforming its sector by 4.28% on the day. The stock has been on a consistent upward trajectory, registering gains for five consecutive days and delivering a cumulative return of 7.44% during this period. This positive momentum is further underscored by the stock touching an intraday high of ₹338, representing a 6.34% rise from previous levels. Compared to the broader market, the stock has outpaced the Sensex, which recorded a modest 0.31% gain over the past week, highlighting V-Guard’s relative strength in the current market environment.

Despite this recent rally, the stock’s longer-term performance remains mixed. Over the past year, V-Guard has generated a negativ...

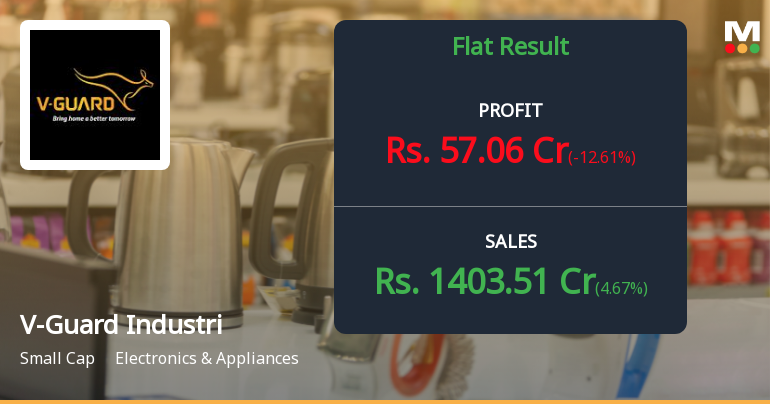

Read full news articleAre V-Guard Industries Ltd latest results good or bad?

2026-01-28 19:15:34V-Guard Industries Ltd's latest financial results for Q2 FY26 indicate a company facing operational challenges amid a tough demand environment. The net sales for the quarter were reported at ₹1,340.92 crores, reflecting a year-on-year growth of 3.63%. However, this figure represents a sequential decline of 8.54% from the previous quarter, highlighting a concerning trend in demand momentum during a typically strong consumption period. The net profit for the same quarter stood at ₹65.29 crores, which is a 3.00% increase year-on-year but a decline of 11.59% compared to the previous quarter. This decline raises questions about the sustainability of earnings, especially as the profit after tax margin contracted to 4.87% from 5.04% in the previous quarter. Operating margins also showed a decline, with the operating profit margin at 8.15%, down from 8.43% sequentially and 8.52% year-on-year. This margin compress...

Read full news article

V-Guard Industries Q2 FY26: Margin Pressure and Volume Challenges Cloud Growth Story

2026-01-28 16:01:12V-Guard Industries Ltd., Kerala's leading electrical and consumer durables manufacturer with a market capitalisation of ₹13,869.21 crores, reported a modest net profit of ₹65.29 crores for Q2 FY26, marking a 3.00% year-on-year growth but an 11.59% sequential decline from the previous quarter. The results reflect mounting operational challenges as the company grapples with margin compression and tepid volume growth, triggering a bearish technical trend that has persisted since early November 2025.

Read full news article

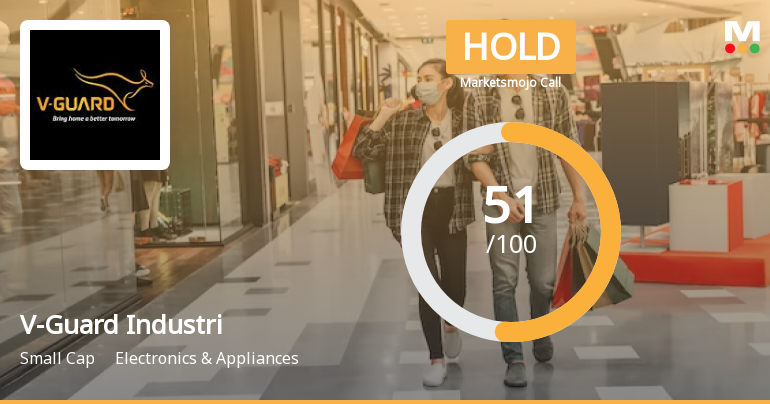

V-Guard Industries Ltd is Rated Hold

2026-01-26 10:10:30V-Guard Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 11 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 26 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

V-Guard Industries Ltd is Rated Hold by MarketsMOJO

2026-01-15 10:10:27V-Guard Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 11 Nov 2025. However, the analysis and financial metrics discussed below reflect the company’s current position as of 15 January 2026, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article