Key Events This Week

Feb 2: Stock opens week at Rs.1,089.75, up 1.12% despite Sensex decline

Feb 3: Intraday high of Rs.1,167.55 with a 7.29% surge

Feb 4: Valuation metrics shift from attractive to fair

Feb 5: Quarterly results reveal strong profit growth but valuation concerns

Feb 6: Mixed quarterly trends reported; stock closes at Rs.1,214.30 (+2.49%)

Are Va Tech Wabag Ltd latest results good or bad?

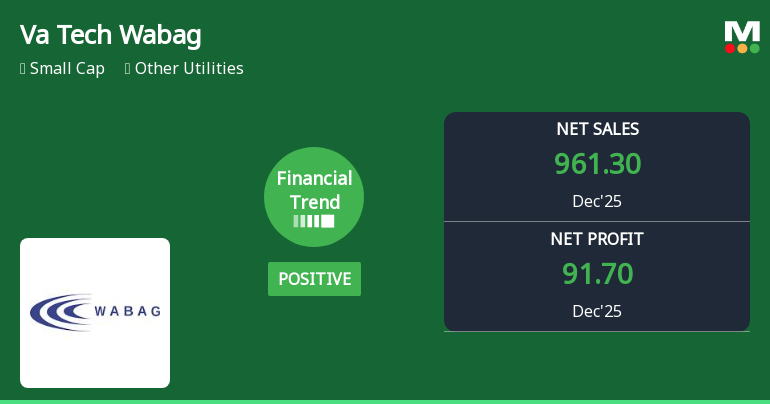

2026-02-06 19:27:17VA Tech Wabag Ltd's latest financial results for the quarter ended December 2025 reveal a period of notable operational performance. The company reported consolidated net sales of ₹961.30 crores, reflecting an 18.53% year-on-year growth compared to ₹811.00 crores in the same quarter last year. This growth is indicative of strong order execution and project ramp-ups within its water infrastructure portfolio, marking the strongest quarterly revenue performance in recent history. Consolidated net profit reached ₹91.70 crores, demonstrating a significant year-on-year growth of 30.63%. This profit growth notably outpaced revenue growth, showcasing the company's ability to convert top-line gains into improved bottom-line results. The operating profit margin stood at 12.64%, which represents a year-on-year improvement of 26 basis points, indicating resilience in profitability despite the capital-intensive nature ...

Read full news article

Va Tech Wabag Ltd Reports Mixed Quarterly Results Amid Shifting Financial Trends

2026-02-06 16:00:26Va Tech Wabag Ltd has delivered a strong quarterly performance for the December 2025 quarter, showcasing significant growth in profitability metrics despite a shift in its overall financial trend from positive to flat. The company’s latest results highlight a marked improvement in operating efficiency and debt management, although its stock returns have shown mixed signals compared to broader market benchmarks.

Read full news article

VA Tech Wabag Q3 FY26: Strong Profit Growth Amid Revenue Momentum, But Valuation Concerns Persist

2026-02-05 19:33:37VA Tech Wabag Ltd., a leading global water treatment solutions provider with a market capitalisation of ₹7,359 crores, delivered a robust performance in Q3 FY26 with consolidated net profit surging 30.63% year-on-year to ₹91.70 crores. However, the stock has struggled to translate operational strength into market gains, declining 8.64% year-to-date and trading 29.12% below its 52-week high of ₹1,679. At ₹1,190, the shares remain in a confirmed bearish technical trend, raising questions about whether the company's improving fundamentals can overcome mounting valuation concerns and negative market sentiment.

Read full news article

Va Tech Wabag Ltd Valuation Shifts Signal Changing Market Sentiment

2026-02-04 08:02:16Va Tech Wabag Ltd has experienced a notable shift in its valuation parameters, moving from an attractive to a fair valuation grade amid evolving market dynamics. With its price-to-earnings (P/E) ratio now at 22.85 and price-to-book value (P/BV) at 3.15, investors are reassessing the stock’s price attractiveness relative to its historical averages and peer group benchmarks.

Read full news article

Va Tech Wabag Ltd Hits Intraday High with 7.29% Surge on 3 Feb 2026

2026-02-03 12:47:34Va Tech Wabag Ltd demonstrated robust intraday performance on 3 Feb 2026, surging to a day’s high of Rs 1,167.55, marking a 7.14% increase from the previous close. The stock outperformed its sector and broader market indices, reflecting notable trading momentum amid a mixed market backdrop.

Read full news article

Va Tech Wabag Ltd is Rated Sell by MarketsMOJO

2026-02-01 10:10:22Va Tech Wabag Ltd is rated Sell by MarketsMOJO, with this rating last updated on 03 Nov 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 01 February 2026, providing investors with the latest insights into the stock’s performance and outlook.

Read full news articleWhen is the next results date for Va Tech Wabag Ltd?

2026-01-28 23:16:30The next results date for Va Tech Wabag Ltd is scheduled for February 5, 2026....

Read full news article

Va Tech Wabag Ltd Stock Falls to 52-Week Low of Rs.1041.6

2026-01-27 10:37:33Va Tech Wabag Ltd’s stock price declined to a fresh 52-week low of Rs.1041.6 today, marking a significant downturn amid broader market fluctuations and sectoral pressures. The stock has underperformed its peers and the benchmark indices over the past year, reflecting a combination of subdued growth metrics and valuation concerns.

Read full news article