Key Events This Week

27 Jan: Stock hits lower circuit at ₹135.75 amid heavy selling pressure

27 Jan: Mixed technical signals with bullish momentum shift noted

30 Jan: Week closes at ₹135.65, down 6.87% for the week

Feb 03

BSE+NSE Vol: 22.17 k

Viceroy Hotels Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 03 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

27 Jan: Stock hits lower circuit at ₹135.75 amid heavy selling pressure

27 Jan: Mixed technical signals with bullish momentum shift noted

30 Jan: Week closes at ₹135.65, down 6.87% for the week

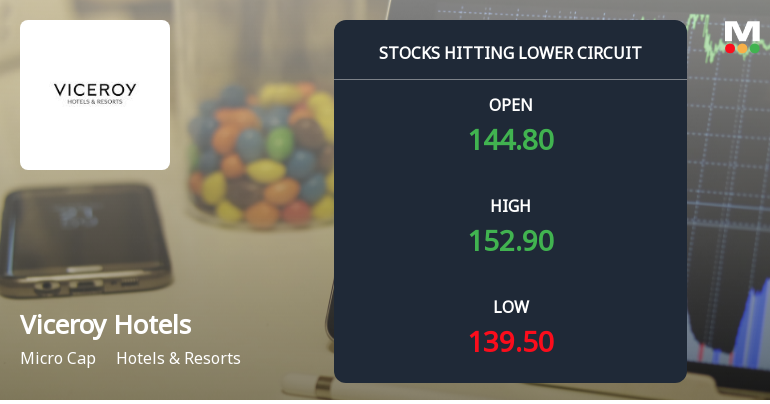

Shares of Viceroy Hotels Ltd plunged to their lower circuit limit on 27 Jan 2026, reflecting intense selling pressure and panic among investors. The stock recorded a maximum daily loss of 5%, closing at ₹135.75 after a volatile session marked by unfilled supply and a sharp decline in investor participation.

Read full news article

Viceroy Hotels Ltd has demonstrated a notable shift in price momentum, moving from a mildly bullish to a bullish technical trend, supported by key indicators such as MACD, Bollinger Bands, and moving averages. Despite some mixed signals on monthly charts, the stock’s recent performance and technical parameters suggest a cautiously optimistic outlook for investors in the Hotels & Resorts sector.

Read full news article

Jan 19: Stock opens strong at ₹140.85 (+2.07%) despite Sensex decline

Jan 20: Technical momentum shift amid mixed indicator signals

Jan 22: Surges to upper circuit at ₹138.75 (+4.99%) on strong buying

Jan 23: Hits upper circuit again at ₹145.65 (+4.97%) closing the week

Viceroy Hotels Ltd surged to its upper circuit limit on 23 Jan 2026, registering a maximum daily gain of 5.0% and closing at ₹145.54. The stock demonstrated robust buying interest despite a broader market downturn, outperforming its sector and the Sensex, while triggering a regulatory freeze due to unfilled demand and liquidity constraints.

Read full news article

Viceroy Hotels Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 September 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 23 January 2026, providing investors with an up-to-date view of the company's fundamentals, valuation, financial trends, and technical outlook.

Read full news article

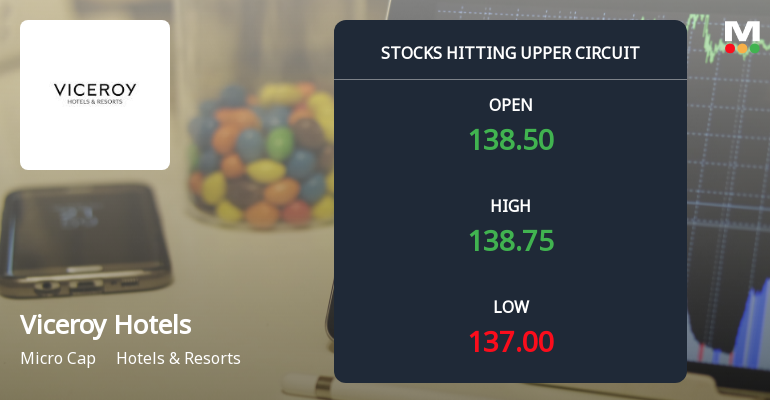

Viceroy Hotels Ltd witnessed a robust rally on 22 Jan 2026, hitting its upper circuit limit with a 5.0% gain to close at ₹138.61. This surge was driven by intense buying interest, resulting in the stock outperforming its sector and broader market indices despite a recent downtrend.

Read full news article

Viceroy Hotels Ltd has experienced a nuanced shift in its technical momentum, moving from a bullish to a mildly bullish stance, as reflected in recent indicator readings. Despite a day’s decline of 2.59%, the stock’s mixed signals across MACD, RSI, moving averages, and other technical tools suggest a complex outlook for investors navigating the Hotels & Resorts sector.

Read full news articleCertificate under Reg 74 (5) of SEBI (DP) Regulations 2018 for the quarter ended 31.12.2025

Disclosure under Regulation 30 pursuant to signing of Sale Deed

Disclosure under Reg 30 on Acquisition of shares

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Viceroy Hotels Ltd has announced 7:10 rights issue, ex-date: 29 Nov 24