Is Virginia National Bankshares Corp. overvalued or undervalued?

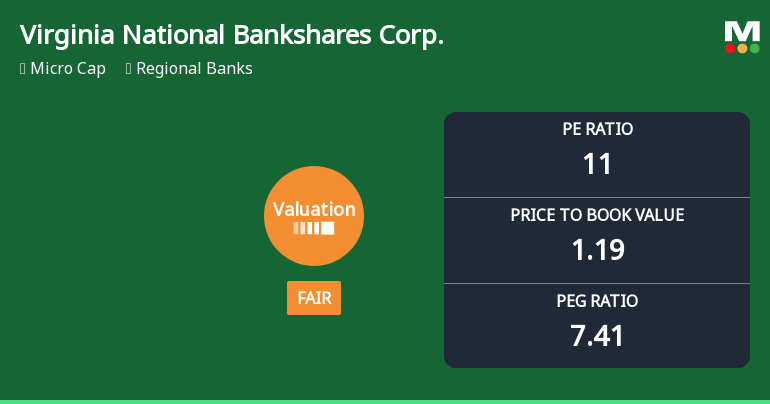

2025-12-01 11:05:50As of 28 November 2025, Virginia National Bankshares Corp. has moved from an attractive to a fair valuation grade. The company appears to be overvalued based on its current metrics. Key ratios include a P/E ratio of 11, a Price to Book Value of 1.19, and an EV to EBITDA of 8.76, which are below the industry averages. In comparison, Community West Bancshares has a P/E of 15.19, while Bankwell Financial Group, Inc. has a fair valuation with a P/E of 17.22, indicating that Virginia National is lagging behind its peers. Despite a recent stock return of 6.28% year-to-date, which is significantly lower than the S&P 500's 16.45% return, the longer-term performance shows a stark contrast, with a 3-year return of 16.17% compared to the S&P 500's 72.78%. This suggests that while the stock has had some short-term gains, it has underperformed relative to broader market benchmarks over longer periods, reinforcing the v...

Read full news articleIs Virginia National Bankshares Corp. overvalued or undervalued?

2025-11-30 11:06:11As of 28 November 2025, the valuation grade for Virginia National Bankshares Corp. has moved from attractive to fair. The company is currently fairly valued based on its financial metrics. Key ratios include a P/E ratio of 11, a Price to Book Value of 1.19, and an EV to EBITDA of 8.76. In comparison to peers, Community West Bancshares has a higher P/E of 15.19, while Colony Bankcorp, Inc. shows a lower P/E of 10.86. In terms of stock performance, Virginia National Bankshares has underperformed against the S&P 500 over the longer term, with a 3-year return of 16.17% compared to the S&P 500's 72.78%. This suggests that while the company is fairly valued, its growth potential may not be as strong as that of the broader market....

Read full news articleIs Virginia National Bankshares Corp. overvalued or undervalued?

2025-11-23 11:11:31As of 21 November 2025, the valuation grade for Virginia National Bankshares Corp. moved from fair to attractive, indicating a positive shift in its valuation outlook. The company appears undervalued, supported by a P/E ratio of 11, a price to book value of 1.19, and an EV to EBITDA ratio of 8.76. In comparison to peers, Community West Bancshares has a higher P/E of 15.19, while Colony Bankcorp, Inc. has a lower EV to EBITDA of 10.86, highlighting Virginia National's relative valuation attractiveness. Despite recent stock performance lagging behind the S&P 500, with a year-to-date return of 2.46% compared to 12.26%, the long-term outlook remains promising, particularly with a 5-year return of 55.32% against the S&P's 85.61%. This suggests that while current performance may not reflect its valuation, the company's fundamentals indicate potential for future growth....

Read full news articleIs Virginia National Bankshares Corp. overvalued or undervalued?

2025-11-11 11:33:43As of 7 November 2025, the valuation grade for Virginia National Bankshares Corp. moved from fair to attractive, indicating a positive shift in its valuation outlook. The company appears undervalued, especially when considering its P/E ratio of 11, which is notably lower than the peer average of approximately 12.61. Additionally, the Price to Book Value stands at 1.19, and the EV to EBITDA ratio is 8.76, both suggesting that the company is trading at a discount compared to its peers. In comparison to its industry peers, Community West Bancshares has a higher P/E of 15.19, while Colony Bankcorp, Inc. shows an EV to EBITDA of 10.86, reinforcing the notion that Virginia National Bankshares Corp. is undervalued. Although recent stock return data is not available, the company's valuation metrics suggest a more favorable position compared to the broader market....

Read full news article

Virginia National Bankshares Corp. Experiences Valuation Adjustment Amidst Regional Banking Landscape

2025-11-10 16:22:26Virginia National Bankshares Corp. has recently adjusted its valuation, with its stock price at $39.00. Over the past year, it has seen a decline of 6.70%. Key financial metrics include a P/E ratio of 11 and an ROCE of 11.06%, positioning it competitively within the regional banking sector.

Read full news articleIs Virginia National Bankshares Corp. overvalued or undervalued?

2025-11-09 11:09:00As of 7 November 2025, the valuation grade for Virginia National Bankshares Corp. has moved from fair to attractive, indicating a positive shift in its valuation outlook. The company appears undervalued based on key metrics, including a P/E ratio of 11, which is lower than the peer average of 12.61, and an EV to EBITDA ratio of 8.76, suggesting it is trading at a discount relative to its earnings potential. Additionally, the Price to Book Value stands at 1.19, which is competitive within the industry. In comparison to its peers, Community West Bancshares has a higher P/E ratio of 15.19, while Colony Bankcorp, Inc. shows an attractive valuation with an EV to EBITDA of 10.86. The recent stock performance shows that Virginia National Bankshares Corp. has underperformed the S&P 500 year-to-date, with a return of 2.09% compared to the index's 14.40%. However, over the last five years, the stock has returned 60....

Read full news article