Key Events This Week

27 Jan: Technical momentum shifts amid mixed indicator signals

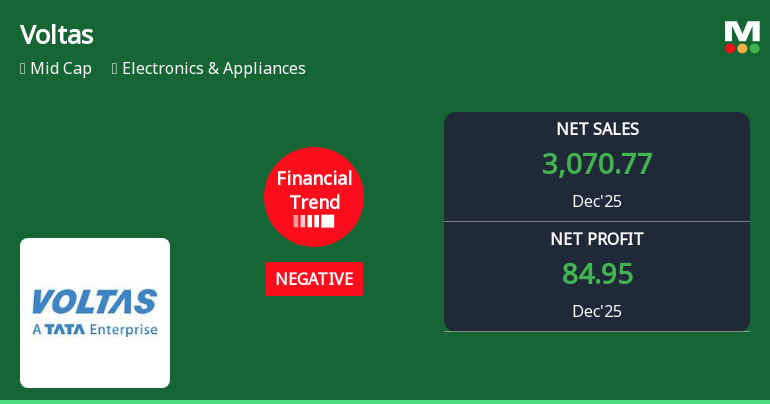

29 Jan: Sharp profit decline reported in Q3 FY26 results

29 Jan: Technical momentum remains sideways with mixed market signals

30 Jan: Mixed quarterly results amid margin pressures and revenue decline